The crypto trade went by a interval of evolution in 2023 to reiterate its place within the world market. This evolution was significantly spearheaded by Bitcoin’s dominance, with the crypto registering good points within the final quarter that have been virtually absent within the earlier elements of the yr.

All the indicators are there; curiosity is choosing up, huge cash from establishments is sniffing round once more, a number of necessary technical and on-chain pricing fashions this yr have been confirmed, and the mud appears to have lastly settled from the extended bear market in 2022.

Total market cap at $1.59 trillion | Source: Crypto Total Market Cap on Tradingview.com

The Crypto Winter Thaws: Signs of Life in 2023

2023 was majorly a yr of correction for the prolonged bear market in 2022 which noticed Bitcoin fall 76% from its all-time excessive to commerce at a backside of $15,883. According to a report from Glassnode, main market construction shifts at the moment are happening inside the crypto trade to replicate rising optimism.

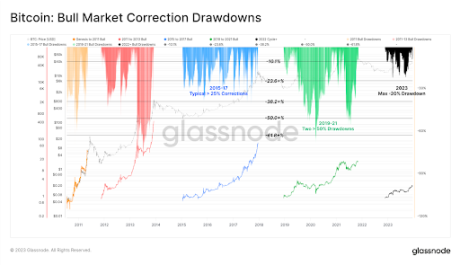

Bitcoin, for one, is displaying a robust curiosity from its long-term holders, because the trade awaits the launch of spot Bitcoin ETFs within the US. One specific function of the yr that indicated a robust bullish momentum was the shallow depth of market correction, indicating the trade is maturing right into a extra secure market by way of value volatility.

Bitcoin’s deepest correction in 2023 closed simply -20% under the native excessive, higher than historic pullbacks of least -25% to -50%.

Source: Glassnode

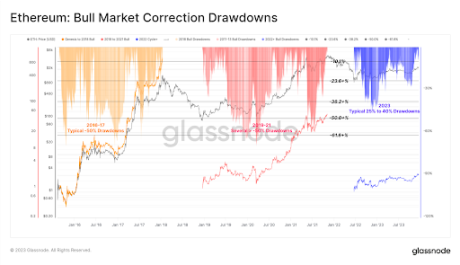

Ethereum additionally noticed shallow corrections, with the deepest reaching -40% in early January.

Source: Glassnode

From an on-chain perspective, the realized cap within the 2022 bear marketplace for each property confirmed a web capital outflow of -18% for BTC and -30% for ETH. The momentum kickstarted in October, because the information of assorted functions of spot Bitcoin ETFs turned the crypto market on its heels. As a end result, Bitcoin lastly broke above the $30,000 degree which it had traded under for almost all of the yr.

This cascaded into the altcoin market, with Solana, Cardano, and Ethereum all seeing renewed curiosity and development in costs and DeFi TVL. According to Glassnode, the full worth locked into Ethereum’s layer-2 blockchains elevated by 60%, with over $12 billion now locked into bridges.

According to CoinShares, the bullish sentiment has additionally flowed into establishments. October’s rally sparked an 11-week run of inflows into digital asset funding funds. At the time of writing, the year-to-date inflows now sit at $1.86 billion.

The crypto trade, significantly Bitcoin, is primed for astounding development in 2024, with numerous value catalysts just like the SEC’s approval of spot Bitcoin and Ethereum ETFs within the US, and the following Bitcoin halving. The altcoin market must also observe, spearheaded by Ethereum.

At the time of writing, Bitcoin is up by 159% this yr, outperforming different asset courses. On the opposite hand, Ethereum and Solana have dominated the altcoin market, up by 82% and 616% respectively.

Featured picture from CNBC, chart from Tradingview.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your personal analysis earlier than making any funding selections. Use data supplied on this web site fully at your personal threat.