In the Bitcoin house, one query echoes persistently by means of the minds of fans and buyers alike: When will Bitcoin rocket to the moon? While nobody is aware of the reply, there are on-chain metrics and historic patterns that may be adopted to trace down the reply.

Bitcoin Price Analysis: When Will BTC Break Out?

Over the final two weeks, the Bitcoin worth has been in a sideways pattern. After the Bitcoin bulls have been in a position to flip the tide at $24,900, the worth has risen by greater than 25%. Since then, nevertheless, BTC has been buying and selling within the vary between $29.800 and $31.300. Neither bulls nor bears have been in a position to achieve the higher hand and get away of the buying and selling vary in greater time frames.

The famend crypto dealer and analyst “Rekt Capital” believes that every one it takes is a constructive catalyst to present BTC worth motion. According to him, Bitcoin’s present sideways pattern inside a good vary is a mere step away from its final demise. He affirms that “a BTC downtrend is only ever one positive catalyst away from ending. And a BTC uptrend is always one negative catalyst from ending”, including:

BTC has carried out a bullish Monthly shut however is primed for a wholesome technical retest at ~$29250. With worth presently round $30200… I’m wondering what unfavorable catalyst will quickly emerge to facilitate this technical retest.

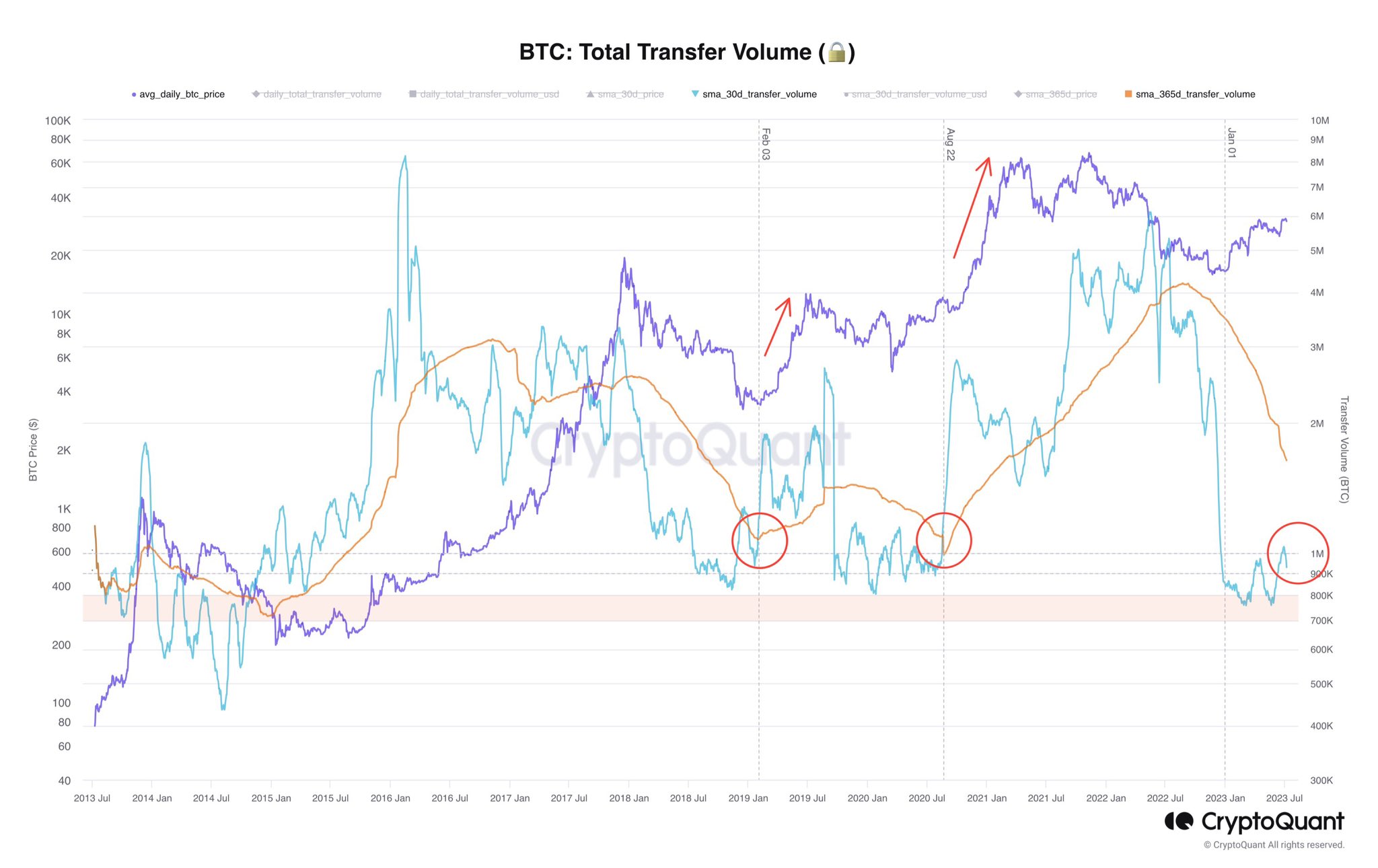

On-chain analyst Axel Adler Jr echoes this view and factors to BTC whole switch quantity as indicator for a large breakout transfer. While the precise timing stays elusive, Adler Jr suggests that the moonshot might be triggered by a major occasion such because the approval of a Bitcoin Exchange-Traded Fund (ETF).

Drawing from historic proof, Adler Jr highlights the correlation between explosive worth pumps and a surge in BTC’s whole switch quantity. Past situations, just like the dramatic surges witnessed in February 2019 and August 2020, lend weight to the argument {that a} related surge might loom simply across the nook.

Bulls Vs. Bears And Whale Games

Daan Crypto Trades remarks on the present state of the market, “They call this candlestick pattern: Thanks for your stops.” Daan’s eager eye eagerly awaits a decisive breakthrough that can propel Bitcoin into a major transfer.

As the battle between bulls and bears ensues, he perceives the continued range-bound exercise as a prelude to an imminent explosion. “Until then it’s just a lot of chop, stop hunts and liquidity grabs until one side comes out victorious.” Once the shackles of this consolidation are shattered, Daan predicts that the ensuing breakout will mark the highest for 2023:

If BTC have been to grind again to the highs from right here, I’d be fairly assured that the following breakout would be the one the place we lastly get away of this space. I additionally suppose this may be the sharpest transfer and certain units the highest for 2023 adopted by a gradual remainder of the yr. […]I might assume we’d go to roughly 36-40K in a fast vogue.

Meanwhile, famend analyst Skew shed mild on the intricacies of Bitcoin’s market dynamics. With an eagle eye on the Binance Spot market, Skew discerns substantial BTC accumulation occurring. He revealed that the provision is concentrated between $31.3K and $32K, whereas demand persists between $29.5K and $28K.

Unveiling the ways of larger gamers, Skew pointed to how whales make use of aggressive brief positions to govern the worth throughout the slim hourly vary, exploiting bid liquidity and provide.

BTC Perp CVD Buckets & Delta Orders – This one actually reveals how rekt apes obtained earlier right now (Long/Short CVD). Whales enjoying the 1-hour vary between good bid liquidity & provide. TWAP orders / CVD reveals aggressive shorts strolling worth again down from $31.4K to $30K.

Featured picture from iStock, chart from TradingView.com