As Binance Coin (BNB) grapples with a turbulent market, its current struggles have highlighted a decline in community exercise, fueling an absence of shopping for strain. The newest roadblock at the formidable $225 resistance degree has compounded the altcoin’s long-term bearish bias, casting a shadow over its prospects within the crypto panorama.

Taking a better look at BNB’s current efficiency, the altcoin confronted a flurry of promoting strain in mid-August, a crucial second that noticed the important thing help degree of $225 remodel into a serious resistance. This shift firmly established bearish dominance on the upper timeframes, shaking investor confidence in BNB’s skill to rally.

However, not all hope was misplaced as bulls rallied from the close by help degree simply above $205, offering a glimmer of optimism amidst the prevailing bearish sentiment.

BNB’s Price and On-Chain Metrics

BNB’s worth, presently hovering at $213 in accordance with CoinGecko, displays the continuing volatility. Over the previous 24 hours, BNB has witnessed a 4.5% decline, whereas its seven-day efficiency reveals a modest acquire of 0.4%.

BNB worth motion at present. Source: Coingecko

The Relative Strength Index (RSI), after a current surge that took it above the impartial 50, skilled a pointy drop from the 60-mark, signaling unstable demand and wavering investor sentiment.

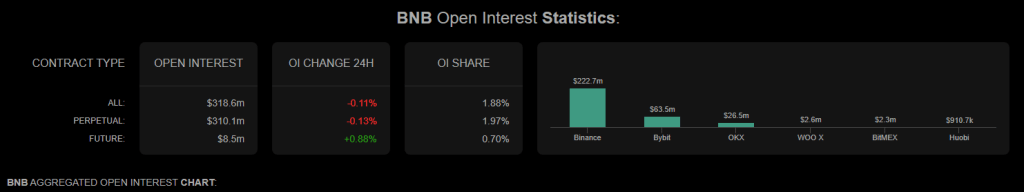

Examining BNB’s on-chain metrics, we discover fascinating developments amongst market speculators. Coinalyze information reveals that the futures market reacted strongly to the short-term pump on August 29, with a pointy drop in Open Interest (OI). This signifies that merchants could also be rising cautious as they navigate the unpredictable waters of the BNB market.

Source: Coinalyze

Prospects for the Future

Looking forward, the destiny of BNB seems to hinge on the weekly time-frame and the closing worth of its charts. If the week concludes with a robust closure above the $230 mark, patrons might seize the initiative.

This potential resurgence might pave the best way for an extra climb in the direction of the $240 zone, providing a glimmer of hope for BNB fans. However, a separate report highlights that such a situation stays related solely till mid-September, and the market’s temper can shift quickly.

BNB market cap presently at $32.9 billion. Chart: TradingView.com

BNB faces important challenges as it grapples with declining community exercise and a persistent lack of shopping for strain. The current rejection at the $225 resistance degree has cemented a bearish bias on the upper timeframes, leaving traders to intently monitor BNB’s worth actions and on-chain metrics for indicators of a possible turnaround.

Amidst this uncertainty, market individuals should stay vigilant and adaptable, because the cryptocurrency panorama is understood for its speedy fluctuations and ever-changing dynamics.

(This website’s content material shouldn’t be construed as funding recommendation. Investing includes danger. When you make investments, your capital is topic to danger).

Featured picture from Telegaon