In a complete analysis of worldwide market dynamics, Bloomberg Intelligence analyst and Chartered Market Technician (CMT) Jamie Coutts has opined on the shifting sands of monetary asset volatility. With bonds doubtlessly falling out of favor and Bitcoin cementing its place as a debasement hedge, conventional portfolio fashions could also be on the verge of a renaissance.

Major Portfolio Shift Towards Bitcoin?

Coutts tweeted, “It looks like we are about to see a substantial uptick in volatility across all markets, given where yields, USD, & global M2 are heading. Despite what lies ahead, there has been a big shift in the volatility profiles of global assets vs. Bitcoin over the past years.”

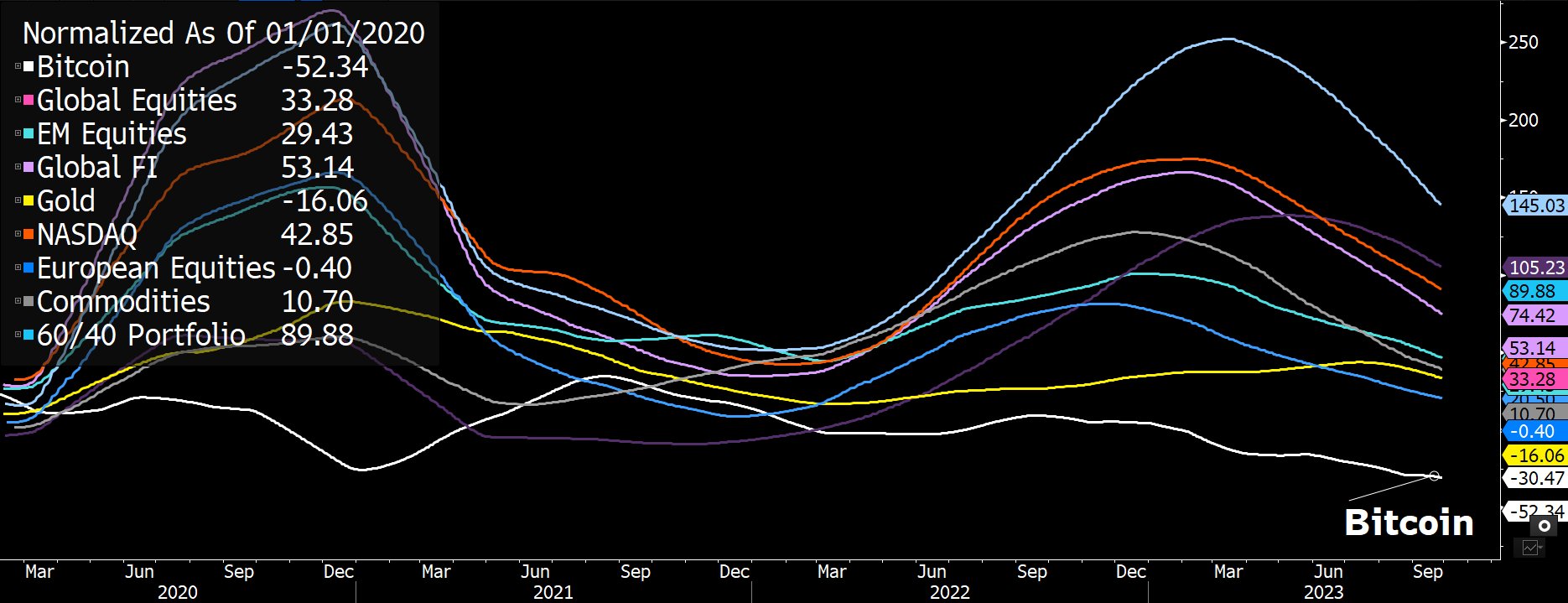

A comparative evaluation by Coutts highlighted that since 2020, the volatility profiles of Bitcoin and Gold have declined, whereas most different belongings have seen a rise in volatility.

His breakdown signifies that the standard 60/40 portfolio volatility is up by 90%, NASDAQ’s volatility has surged by 53%, and international fairness volatility rose by 33%; in the meantime, solely Bitcoin’s volatility decreased by 52% in addition to Gold’s volatility, which went down by 6%

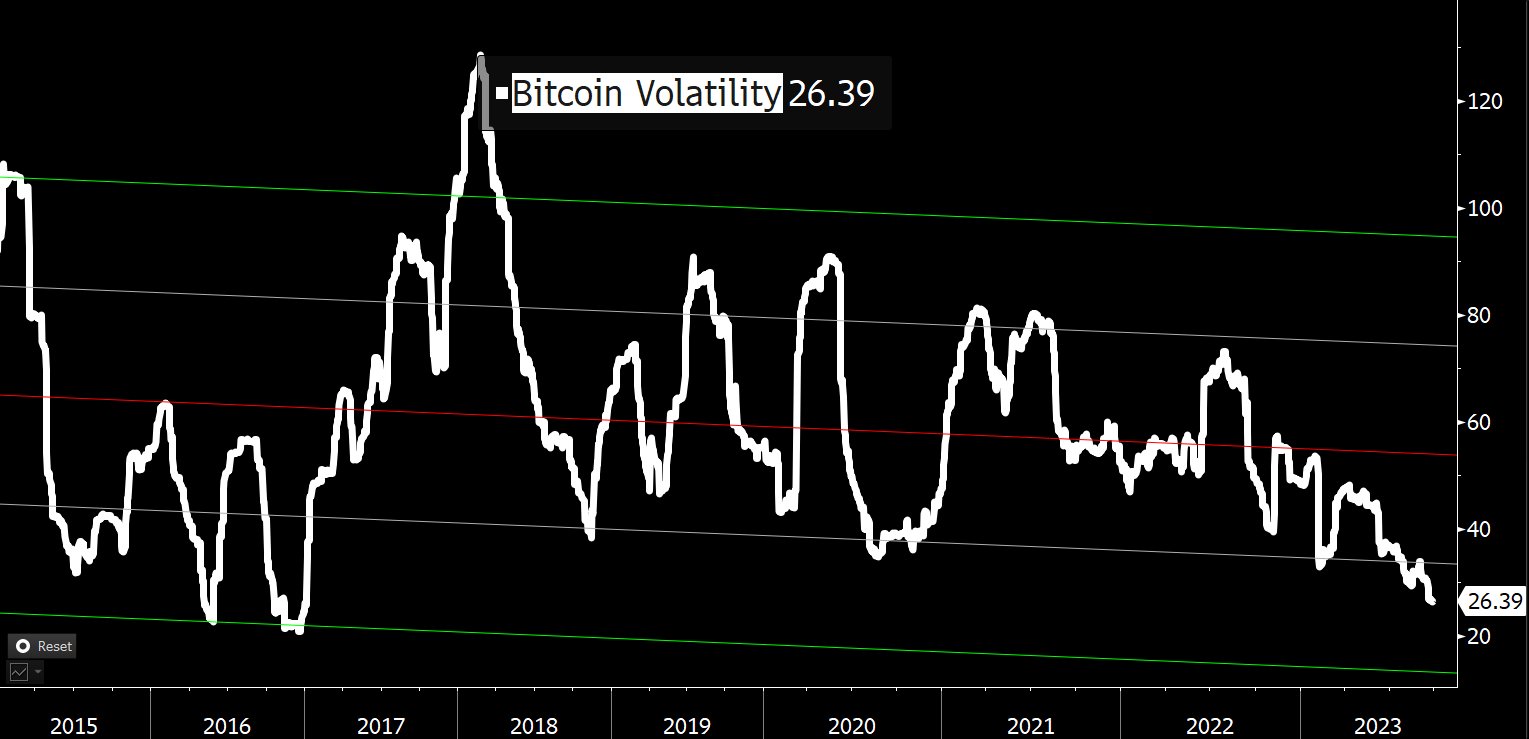

Coutts additional elaborated that following the “hyper-volatile” part of Bitcoin throughout 2011-14, the cryptocurrency’s volatility has been on a downward trajectory. From a peak above 120 in early 2018, this metric at present stands at 26.39.

However, Coutts maintains skepticism over Bitcoin’s short-term prospects given the deteriorating macro setting: “Given that BTC volatility is near the bottom of the range plus a deteriorating macro environment: US dollar (DXY) is up, 10Y Treasury Yield is up, Global M2 money supply is up. It’s difficult to see how BTC (& all risk assets) can hold up with this setup.”

BTC Vs. Global Asset Classes

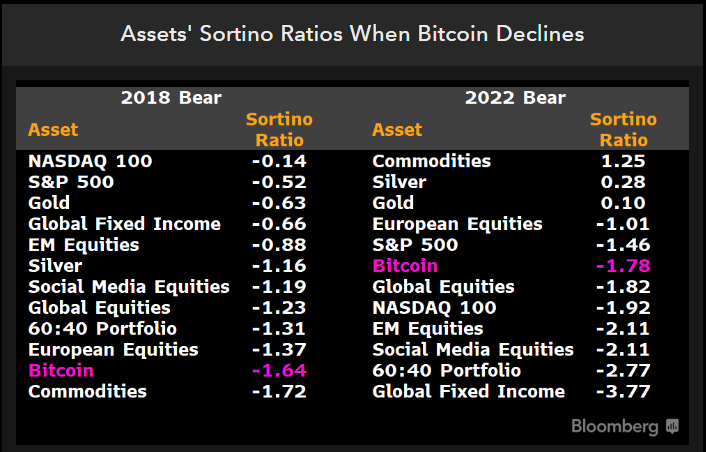

On the brilliant aspect, from an asset allocation perspective, Coutts considers the actual query to be whether or not “Bitcoin can add value as a risk diversifier & improve risk-adjusted returns.” Comparing the risk-adjusted returns utilizing the Sortino ratio over the past bear market, Bitcoin’s efficiency will not be one of the best.

In the 2022 bear market, Bitcoin’s Sortino ratio is -1.78, positioning BTC above international equities, the NASDAQ 100, and the standard 60:40 portfolio. However, it trails the S&P 500 (-1.46), European Equities (-1.01), Gold (+0.1), Silver (+0.28), and commodities (+1.25).

Elaborating on the cyclical habits of Bitcoin, Coutts added, “The problem with BTC is the relatively short history makes inferences difficult and 1 year periods are certainly not significant. The best we can go on is multiple cycles. It’s clear that holding over the full cycle has been a winning strategy.”

Evaluating the Sortino ratio over the previous three Bitcoin cycles (2013-2022), Coutts discovered Bitcoin to steer with a rating of two.46, outperforming the NASDAQ 100 (+1.37), S&P 500 (+1.25), and international equities (+1.05).

BTC: Top Bet Against Money Printing

In this situation, Debasement considerations additional improve Bitcoin’s proposition. Coutts emphasised this saying, “And if allocators want to outpace monetary debasement, over most timeframes, bonds are not the place to be.” He recognized Bitcoin because the foremost selection for portfolio reallocation towards financial debasement.

Citing the huge distinction between asset returns regarding cash provide development (M2) over the previous 10 years, he highlighted Bitcoin’s dominance with a staggering ratio of +8,598, adopted by NASDAQ (+109), S&P 500 (+25) and international equities (-7.5).

In a concluding assertion, Coutts postulated, “In the years ahead it’s conceivable that allocators begin to shift towards better debasement hedges. BTC is an obvious choice.” Moreover, he means that Bitcoin might supplant bonds by securing at the least 1% of the standard 60/40 portfolio.

At press time, BTC traded at $26,433.

Featured picture from Shutterstock, chart from TradingView.com