Identification necessities, excessive charges and a language hole have lengthy been limitations to stopping some Latino immigrants from opening a banking account within the United States. Comun desires to change that.

The New York-based neobank is the newest to present banking companies custom-made to the wants of immigrants. While most conventional banks require prospects to have a U.S. Social Security card or proof of deal with, for instance a mortgage or utility invoice, Comun permits its prospects to apply for an account utilizing 100 completely different identification varieties from Latin America, together with overseas nation passports.

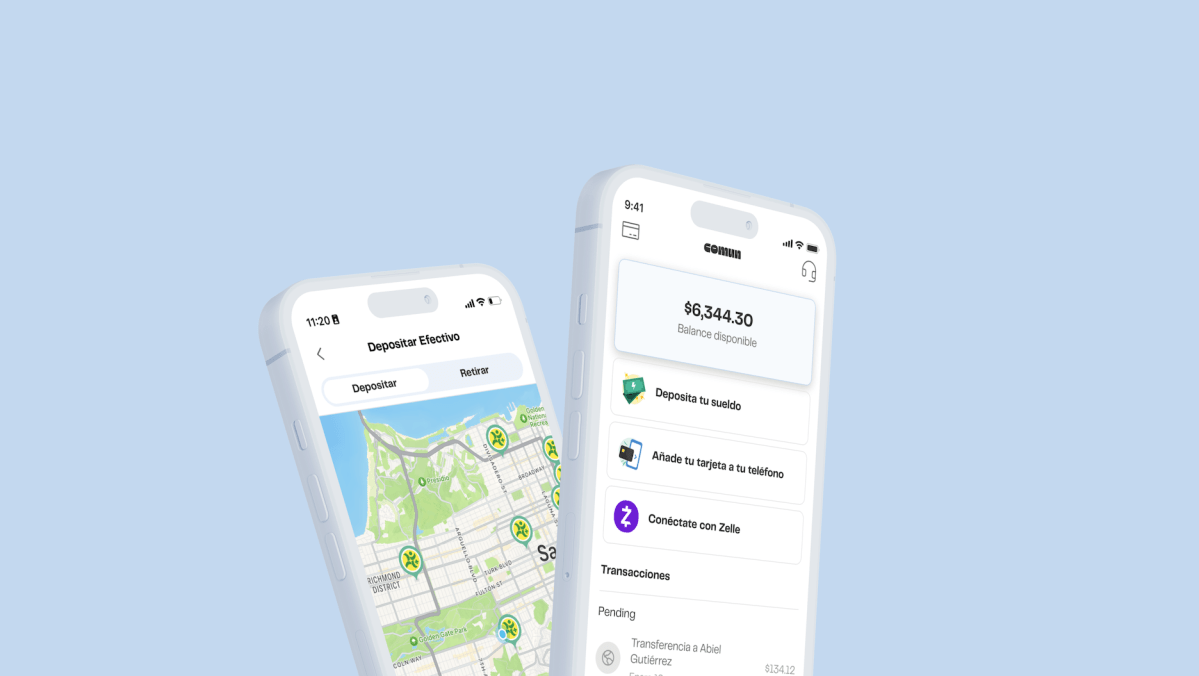

Andres Santos and Abiel Gutierrez began Comun in early 2022 to provide digital banking companies, together with prompt funds, verify deposits and early paychecks. They additionally wished to present prospects with entry to native Spanish-speaking reps seven days every week.

“Our mission is to bring back local banking to immigrants in the U.S.,” Santos advised Ztoog. “We think that is a model that has been dying at alarming rates over the last 30 years. You’ve basically seen ‘too big to fail banks’ taking most of the share and going from 20,000 banks to less than 5,000 banks.”

Abiel Gutierrez and Andres Santos, co-founders of Comun. Image Credits: Comun

Santos additionally defined that in that point, some banks have considered immigrants. However, that group sometimes doesn’t match the mannequin of a possible buyer to go after, so that they get left behind.

Comun desires to “reimagine what local banking looks like in the digital arena, and that means community and the unique needs of our community to better serve them with winning products,” he added.

The financial institution makes cash from curiosity on deposits and likewise comfort charges for facilitating prompt transactions, comparable to peer-to-peer transactions. It additionally launched a direct banking integration up to now month that Santos stated is rising quick and “already driving around 25% of our revenue and volume.” Comun may even gather charges from transactions as soon as it opens up a remittance program it’s piloting that permits immigrants to ship cash from the U.S. to Latin America.

Comun isn’t alone in focusing on immigrants. It joins corporations like Tanda, Bloom Money, Majority, Welcome Tech and Pillar in fixing the financial institution accessibility downside.

It additionally joins them in attracting enterprise capital for its approach. Today, Comun introduced one other $4.5 million in funding to give it $9 million raised in complete. The newest funding was led by Costanoa Ventures with participation from a gaggle of present buyers, together with Animo Ventures, South Park Commons and FJ Labs.

In addition to providing the varied identification strategies for opening accounts, the corporate differentiates itself from its opponents via its partnership with Community Federal Savings Bank. By having a direct relationship with the financial institution, Comun is ready to add new companies shortly and in compliance, Santos stated.

Comun can be growing a big community of companions to help money deposits and withdrawals with greater than 90,000 bodily areas.

The idea has caught on. Not solely has the financial institution achieved a internet promoter rating (NPS) of 86, which is over 4 occasions the trade common by way of buyer satisfaction, however Comun is experiencing 60% month over month income development. It has processed over $75 million via its platform.

Santos and Gutierrez plan to use the brand new funds to rent further staff to scale Comun’s banking companies and launch new merchandise, together with insurance coverage and ultimately going into credit score and underwriting.