The Bitcoin value has been experiencing a part of stagnation over the previous days, leaving traders and analysts trying to find the underlying causes. Three key components could be seen as central to explaining Bitcoin’s present sideways buying and selling development:

#1 ETF Inflows Are Offset By GBTC Selling, But For How Much Longer?

The spot Bitcoin ETFs proceed to be the dominant theme available on the market, and Grayscale specifically, with its GBTC, stays the main focus of analysts. While the ETF inflows proceed to be record-breaking, the Bitcoin value stays flat. One of the principle causes for that is presumably the outflows on GBTC, which is seen as overpriced with its payment of 1.5% per yr (in comparison with 0.25%) by different issuers.

Thomas Fahrer of Apollo pointed out the numerous stream discrepancies available in the market: “In three days of trading. IBIT +16K BTC, FBTC +12K BTC, BITB +6.7K BTC, ARKB +5.3K BTC, GBTC -27K BTC. GBTC BTC is flowing but not enough to sustain the other ETFs. Supply shock inbound imo.”

Alessandro Ottaviani provided additional insights, stating, “Bitcoin influx within the ETFs: +47k, Bitcoin outflow from Grayscale: -27k, internet influx: 20k. […] Soon or later I anticipate Grayscale outflow stopping or lowering considerably. Those who’ve Grayscale GBTC had been already into Bitcoin and due to this fact I believe they already made the choice to promote, the execution of which ought to occur not a lot later than the launch of the ETF.

Bloomberg analysts James Seyffart and Eric Balchunas expect a portion of GBTC outflows emigrate to different Bitcoin exposures, highlighting the complexities of fund accounting and settlement delays in monitoring these actions. They famous, “GBTC has crossed $1.1 billion in outflows…We expect a meaningful percentage of those assets to find their way back into Bitcoin exposure, mostly other ETFs.”

#2 Bitcoin Miners Sell

Ali Martinez has spotlighted the intensified promoting exercise by Bitcoin miners as one other issue influencing the present value stagnation. Recent on-chain information signifies that miners have considerably elevated their Bitcoin gross sales.

Martinez commented on X (previously Twitter), “Bitcoin Miners in Selling Mode: Recent on-chain data from Cryptoquant indicates a substantial increase in selling activity by BTC miners.”

Notably, the shift in miner conduct is in keeping with historic tendencies, the place miners promote their holdings to handle money stream or capitalize on value will increase throughout market rallies.

#3 Consolidation Phase Following ETF Mania

The market is at present present process a consolidation part after the euphoria surrounding Bitcoin ETFs, which led to an 82% rally. Such a part is taken into account pure and mirrors historic patterns seen in different markets, like the primary gold ETF.

Although gold initially recorded a rise of round 6%, it then took a full 9 months to start out the precise rally, which nearly quintupled the worth. The identical goes for the Bitcoin ETFs. It will take a while earlier than the advertising machine of the asset managers begins up and new institutional traders could be satisfied of the brand new asset class.

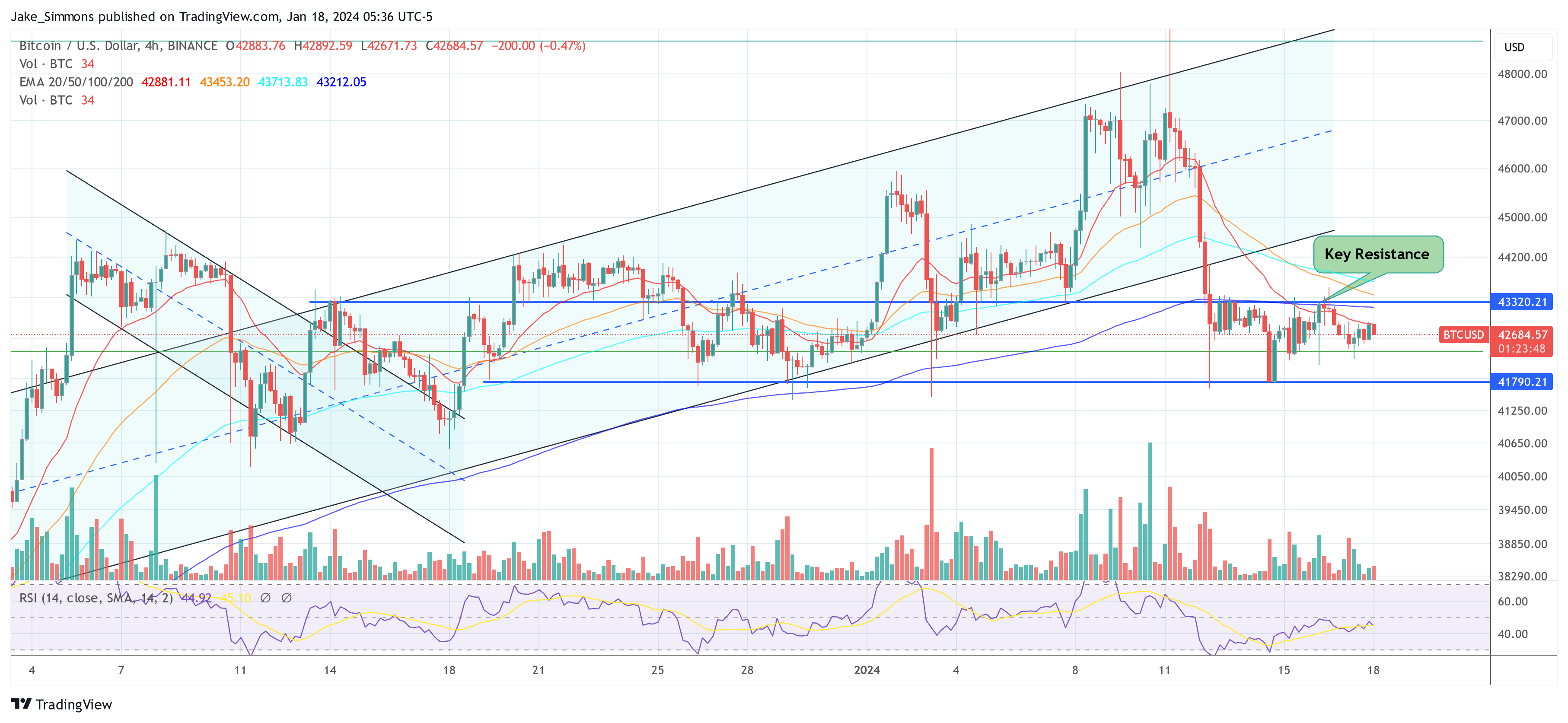

Analyst Skew provided a technical perspective, stating, (*3*)

At press time, BTC traded at $42,684.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your individual analysis earlier than making any funding choices. Use info supplied on this web site solely at your individual danger.