A mysterious whale is quickly accumulating Chainlink (LINK). According to Lookonchain, the unknown entity, presumably an establishment, withdrew over 2.2 million LINK (value $42.38 million) by way of 47 new wallets from Binance, the world’s largest crypto change by buying and selling quantity, in two days.

This sudden block withdrawal now raises questions on what’s driving the whale’s curiosity and what it may imply for LINK within the coming days.

Chainlink Is Key In DeFi And NFTs, Gradually Improving

Chainlink is a well-liked venture that gives safe middleware companies and permits good contracts to entry tamper-proof exterior knowledge. For this position, the platform has been adopted by a number of protocols providing decentralized finance (defi) companies in Ethereum and past.

Additionally, Chainlink performs a task in non-fungible tokens (NFTs) via its random quantity generator (RNG). It continues to launch new merchandise and improve its options.

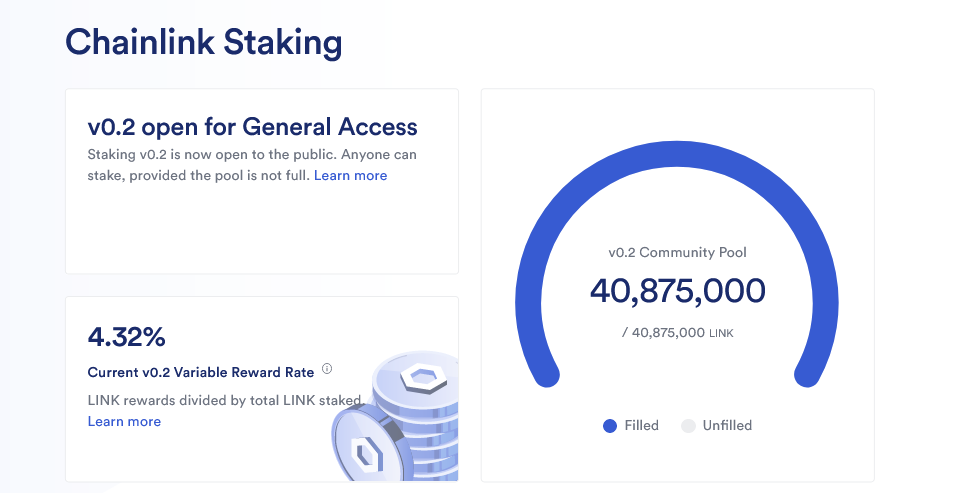

To illustrate, in November, Chainlink upgraded its staking mechanism, releasing v0.2, which considerably elevated the pool measurement to 45 million LINK.

The platform famous that the choice was to draw extra buyers and, extra importantly, bolster its safety whereas concurrently aligning with its broader goal of achieving the “Economics 2.0” plan.

Initially, staking started in December 2022. The aim was to incentivize participation by increasing the utility of LINK and permitting stakers to obtain rewards.

The launch of v0.2 in November means extra tokens will be locked, serving to make LINK scarce, contemplating the position of the token within the huge Chainlink ecosystem.

Trackers present that over 40.8 million LINKs have been locked to date. Chainlink confirms that anybody can earn a variable reward charge of 4.32%.

Beyond staking, Chainlink’s Cross-Chain Interoperability Protocol (CCIP) is gaining adoption. To illustrate, the Hong Kong Monetary Authority (HKMA) initiated its first part of e-Hong Kong Dollar (e-HKD) trials in November, integrating CCIP.

As a part of this trial, the regulator wished as an example the capabilities of programmable funds enabled by Chainlink by way of its resolution, CCIP. In DeFi, protocols corresponding to Synthetix and Aave have adopted CCIP.

Will LINK Breach $20?

With extra protocols and conventional establishments leveraging the know-how, the demand for LINK (and costs) will possible enhance because the concern of lacking out (FOMO) kicks in.

While the whale’s motives stay unknown, their large-scale LINK accumulation suggests they could be bullish on the token. Notably, it coincides with the sharp enlargement of LINK costs previously 48 hours.

So far, the token is altering fingers barely beneath the $20 psychological resistance. Any breakout above this stage may elevate the token to round $35 in Q3 2021.

Feature picture from iStock, chart from TradingView

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your individual analysis earlier than making any funding selections. Use info supplied on this web site totally at your individual threat.