Monty Rakusen/Getty

The yr 2023 was a big one for local weather information, from report warmth to world leaders lastly calling for a transition away from fossil fuels. In a lesser-known milestone, it was additionally the yr the European Union soft-launched an formidable new initiative that might supercharge its local weather insurance policies.

Wrapped in arcane language studded with many a “thereof,” “whereas” and “having regard to” is a coverage that might not solely assist fund the European Union’s pledge to turn out to be the world’s first carbon-neutral continent, but additionally push industries all around the world to lower their carbon emissions.

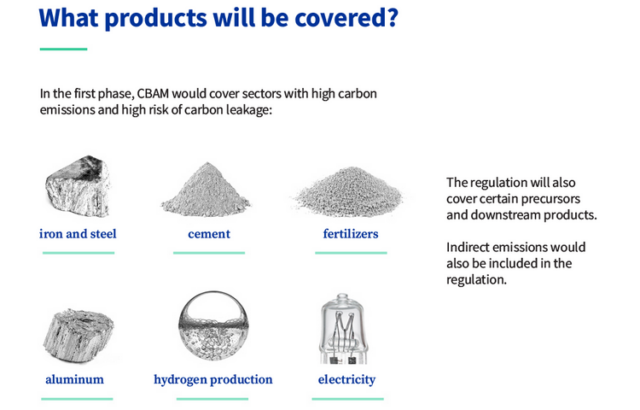

It’s the institution of a carbon worth that can drive many heavy industries to pay for every ton of carbon dioxide, or equal emissions of different greenhouse gases, that they emit. But what makes this price revolutionary is that it’s going to apply to emissions that don’t occur on European soil. The EU already places a worth on lots of the emissions created by European corporations; now, by way of the brand new Carbon Border Adjustment Mechanism, or CBAM, the bloc will cost firms that import the focused merchandise—cement, aluminum, electrical energy, fertilizer, hydrogen, iron, and metal—into the EU, irrespective of the place on the planet these merchandise are made.

These industries are sometimes giant and cussed sources of greenhouse gasoline emissions, and addressing them is vital within the struggle in opposition to local weather change, says Aaron Cosbey, an economist on the International Institute for Sustainable Development, an environmental assume tank. If these firms need to proceed doing enterprise with European corporations, they’ll have to clear up or pay a price. That creates an incentive for firms worldwide to cut back emissions.

In CBAM’s first part, which began in October 2023, firms importing these supplies into the EU should report on the greenhouse gasoline emissions concerned in making the merchandise. Beginning in 2026, they’ll have to pay a tariff.

Even having to provide emissions information can be a big step for some producers and will present priceless information for local weather researchers and policymakers, says Cosbey.

“I don’t know how many times I’ve gone through this exercise of trying to identify, at a product level, the greenhouse gas intensity of exports from particular countries and had to go through the most amazing, torturous processes to try to do those estimates,” he says. “And now it’s going to be served to me on a plate.”

Side advantages at house

While this new carbon worth targets firms overseas, it would additionally assist the EU to pursue its local weather ambitions at house. For one factor, the additional revenues might go towards financing climate-friendly tasks and promising new applied sciences.

But it additionally permits the EU to tighten up on home air pollution. Since 2005, the EU has set a most, or cap, on the emissions created by a variety of commercial “installations” equivalent to oil and steel refineries. It makes firms inside the bloc use credit, or allowances, for every ton of carbon dioxide—or equal discharges of different greenhouse gases—that they emit, up to that cap. Some allowances are at present granted without cost, however others are purchased at public sale or traded with different firms in a system generally known as a carbon market.

But this concept—of constructing it costly to hurt the planet—creates a conundrum. If doing enterprise in Europe turns into too costly, European trade might flee the continent for nations that don’t have such excessive charges or strict rules. That would harm the European economic system and do nothing to resolve the environmental disaster. The greenhouse gases would nonetheless be emitted—maybe greater than if the merchandise had been made in Europe—and local weather change would careen ahead on its damaging path.

The Carbon Border Adjustment Mechanism goals to impose the identical carbon worth for merchandise made overseas as home producers should pay below the EU’s system. In principle, that retains European companies aggressive with imports from worldwide rivals. It additionally addresses environmental issues by nudging firms abroad towards lowering greenhouse gasoline emissions relatively than carrying on as typical.

This means the EU can additional tighten up its carbon market system at house. With worldwide competitors hopefully much less of a priority, it plans to part out some leniencies, equivalent to among the free emission allowances, that existed to assist preserve home industries aggressive.

That’s a big deal, says Cosbey. Dozens of nations have carbon pricing techniques, however all of them create exceptions to preserve heavy trade from getting obliterated by worldwide competitors. The carbon border tariff might permit the EU to really drive its industries—and customers—to pay the worth, he says.

“That is ambitious; nobody in the world is doing that.”