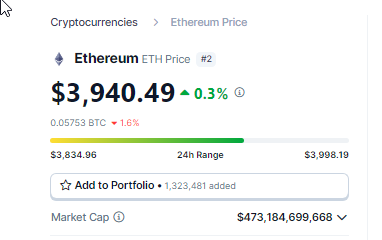

Cryptocurrency lovers are celebrating a bullish weekend for Ethereum (ETH), the world’s second-largest cryptocurrency by market capitalization. With a value surge of 4.31% within the final day, ETH is inching nearer to a essential resistance level: $4,000. This climb comes amidst a wave of optimism surrounding the Ethereum community, fueled by a confluence of things.

Ethereum Whale Activity, On-Chain Buying Signal Potential Rally

Market analysts are attributing the latest surge to a major rise in Ethereum accumulation. According to information from blockchain monitoring firm Spot On Chain, wallets linked to PulseChain and PulseX have been aggressively shopping for ETH, accumulating a staggering 163,295 ETH in simply 4 days. This substantial shopping for strain, totaling almost $621 million DAI, suggests a powerful basis for a possible value enhance.

Furthermore, greater than $10 billion whale commerce quantity recorded in a single day signifies a shift in sentiment amongst main buyers. This hefty commerce quantity is seen as a bullish sign, suggesting that whales are accumulating ETH in anticipation of a value upswing.

Ethereum Investors Buoyed By Profitability, Approaching ATH

Adding gas to the hearth, over 94% of ETH addresses are presently in revenue. This interprets to a major variety of buyers holding onto their ETH, creating low promoting strain and doubtlessly paving the way in which for a value enhance.

Data from IntoTheBlock (ITB), a cryptocurrency analytics platform, signifies that at this level, ETH is at its finest degree in almost a 12 months, however it’s clearly trailing the upward development that Bitcoin skilled as soon as its spot Exchange-Traded Fund obtained approval.

Source: IntoTheBlock

Moreover, the joy surrounding Ethereum is palpable as the worth approaches its all-time excessive (ATH) of $4,890. With minimal resistance anticipated, a retest of the ATH looks like a sensible risk within the close to future. This prospect is additional amplified by the dwindling variety of addresses holding ETH at a break-even level or at a loss.

Dencum Upgrade And ETF Speculation Stoke Investor Confidence

Beyond the fast value motion, the Ethereum neighborhood is buzzing with anticipation concerning the upcoming Dencum improve. This extremely anticipated improve is designed to deal with scalability points, cut back transaction charges on layer networks, and decongest the Ethereum community.

A profitable Dencum improve is anticipated to considerably enhance the general person expertise and doubtlessly appeal to new buyers, bolstering confidence within the long-term viability of the Ethereum community.

Total crypto market cap is presently at $2.5 trillion. Chart: TradingView

Adding one other layer of optimism is the continuing hypothesis surrounding a possible Ethereum ETF. While regulatory approval from the SEC remains to be pending, the very risk of an ETF has buoyed investor sentiment. An ETF would permit conventional buyers to achieve publicity to Ethereum with out the complexities of instantly proudly owning and managing cryptocurrency, doubtlessly resulting in a wider investor base and elevated demand for ETH.

A Look Ahead: Ether Trajectory Hinges On Multiple Factors

While the outlook for Ethereum seems vivid, there are nonetheless elements to contemplate. The value of ETH stays roughly $1,000 shy of its ATH, and the success of the Dencum improve and the approval of an Ethereum ETF will not be assured. As with any funding, conducting thorough analysis and sustaining a cautious method is essential.

However, the confluence of rising on-chain exercise, whale accumulation, and a worthwhile investor base paints a promising image for Ethereum. With the Dencum improve on the horizon and the potential for an ETF, Ethereum seems poised for a possible value rally within the coming months.

Featured picture from Pexels, chart from TradingView

Disclaimer: The article is supplied for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your individual analysis earlier than making any funding selections. Use data supplied on this web site solely at your individual danger.