Key Takeaways

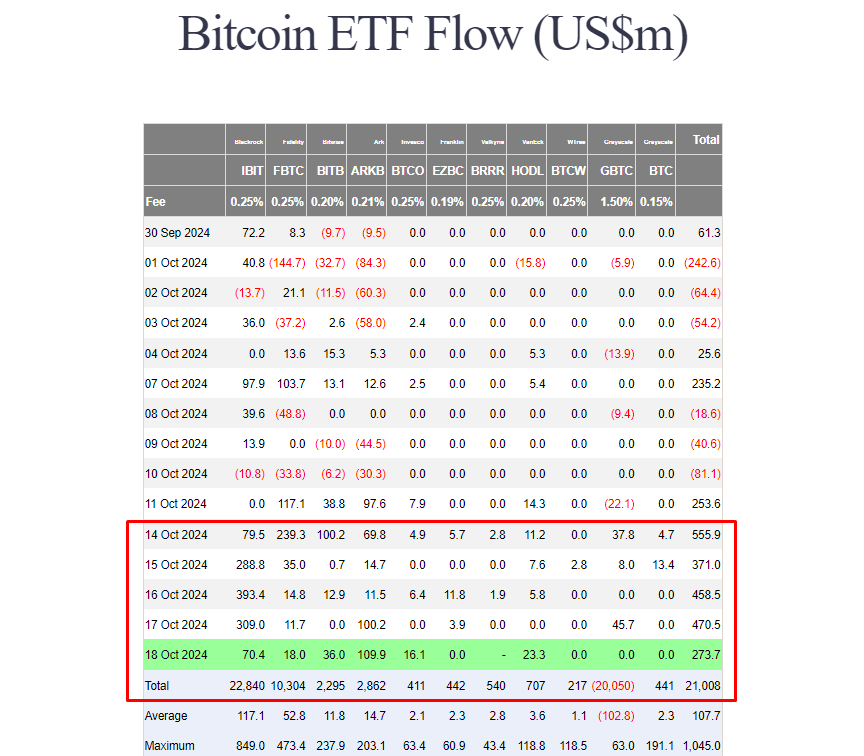

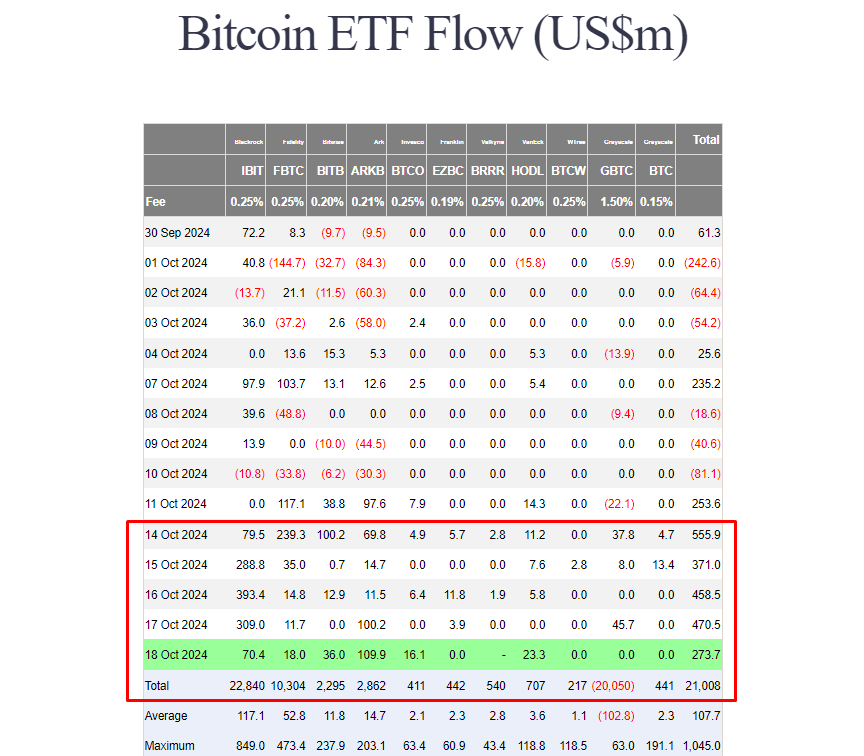

- Bitcoin ETFs reached a complete of $21 billion in net inflows, a document excessive.

- ARKB and IBIT have been the top performers, considerably contributing to the week’s features.

Share this text

US spot Bitcoin ETFs reached $21 billion in whole net inflows on Friday as investor urge for food for these funds stays sturdy. According to knowledge from Farside Investors, these ETFs collectively netted over $2 billion this week, extending their successful streak to 6 consecutive days.

Yesterday alone, spot Bitcoin ETFs, excluding Valkyrie’s BRRR, attracted round $273 million in net purchases. ARK Invest’s ARKB led the group with almost $110 million.

BlackRock’s IBIT additionally logged over $70 million in net inflows on Friday, adopted by VanEck’s HODL, Bitwise’s BITB, Fidelity’s FBTC, and Invesco’s BTCO.

IBIT and ARKB have been the top-performing Bitcoin ETFs this week. ARKB skilled a surge in inflows, surpassing $100 million on each Thursday and Friday.

Meanwhile, half of the group’s inflows got here from IBIT. As of October 18, its net inflows have topped $23 billion, solidifying its place as the world’s premier Bitcoin ETF.

With Friday’s optimistic efficiency, Bitcoin ETFs noticed their first week with no damaging inflows. Even Grayscale’s GBTC, recognized for its historic outflow status, reversed the development with over $91 million in net inflows.

Bitcoin ETF choices to deepen liquidity and convey in additional buyers

On Friday, the SEC authorized NYSE and CBOE’s proposals to record choices for spot Bitcoin ETFs. While the precise launch date has but to be decided, ETF specialists say the approval will increase market entry to crypto-related monetary merchandise on main US exchanges.

Nate Geraci, president of the ETF Store, sees choices buying and selling on spot Bitcoin ETFs will enhance liquidity round Bitcoin ETFs, appeal to extra gamers to the market, and thus make the entire ecosystem extra sturdy.

“In terms of the potential impact here, I think that options trading on spot Bitcoin ETFs is decidedly good. Because all options trading is going to do is deepen the liquidity around spot Bitcoin ETFs,” stated Geraci, talking in a latest episode of Thinking Crypto. “It’s going to bring more players into the space, I would say especially institutional players. To me, it just makes the entire spot Bitcoin ETF ecosystem that much more robust.”

According to Geraci, choices buying and selling is necessary for institutional buyers in hedging and implementing complicated methods, particularly with a risky asset like Bitcoin.

The ETF knowledgeable means that retail buyers, along with institutional gamers, are desirous to entry choices buying and selling for a similar causes.

“Even when we look over to the retail side, with more sophisticated retail investors, they want options trading as well for the same reason,” Geraci said.

Share this text