All new Tesla Model 3 autos will now qualify for the full $7,500 federal EV tax credit, in response to a change in Tesla’s web site.

The EV tax credit have been mandated by Congress final August as a part of the Inflation Reduction Act, with the aim of ending U.S. reliance on China for batteries. The full $7,500 tax credit is damaged into two components. EVs can qualify for half, or $3,750, if 50% of the worth of battery parts have been produced or assembled in North America; the opposite half requires 40% of the worth of important supplies be sourced from the U.S. or one other free commerce settlement nation.

Image Credits: Tesla web site

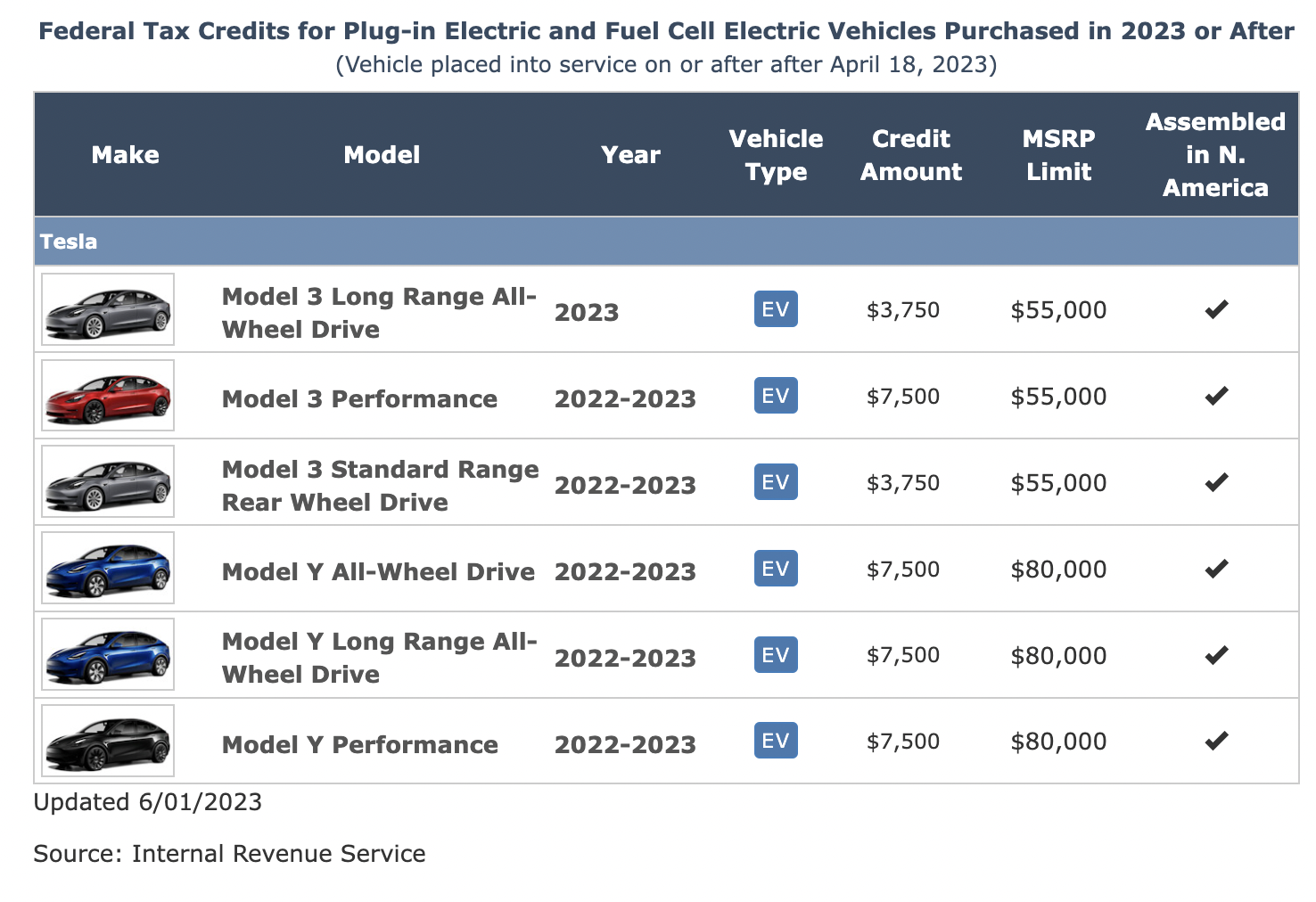

When the tax credit kicked in on January 1, the Treasury Dept. held off on publishing the battery sourcing steerage to be able to give EV-makers time to fulfill the necessities. On April 18, the division started imposing the important materials sourcing requirement, which led to many car fashions shedding the full tax credit that they had been eligible for within the first quarter of the yr.

Tesla’s Model 3 noticed its full credit slashed in half, however many different automakers — like BMW, Rivian, Volvo and Hyundai — misplaced their credit totally.

Now, it seems that all Tesla autos can be eligible for the full $7,500 credit. Previously, the one Model 3 that certified for the full tax credit was the Model 3 Performance. Now, the Model 3 long-range all-wheel drive and rear-wheel drive may also qualify. The Model 3 rear-wheel drive now begins at $32,740 when the tax credit kicks in.

Tesla didn’t say what modified, however CEO Elon Musk retweeted a screenshot of the web site that shows the tax credit accessible for every car. Crucially, the Treasury Dept.’s web site has not but up to date to mirror Tesla’s newfound eligibility for tax credit. The division didn’t but reply to Ztoog’s request for remark.

Image Credits: Internal Revenue Service