In every week marked by the historic debut of spot Bitcoin ETFs on Wall Street, the cryptocurrency market witnessed a surge in inflows, with Bitcoin, Ethereum, and XRP main the cost.

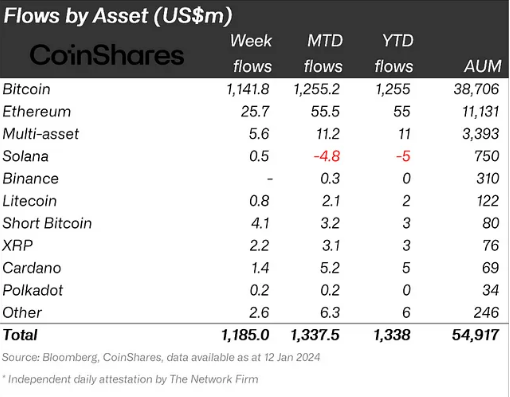

Despite failing to shatter data set by futures-based ETFs, the $1.18 billion inflow paints an image of cautious optimism cautiously welcoming the alpha crypto into the monetary fold.

James Butterfill, the pinnacle of analysis at CoinShares, mentioned that this determine was nonetheless a far cry from the $1.5 billion report of futures-based Bitcoin ETFs in October 2021.

Bitcoin Leads The Pack

While Bitcoin reigned supreme with $1.16 billion in inflows, its worth dipped barely, hinting at investor apprehension. Ethereum, nonetheless, painted a contrasting image, its inflows of $26 million pushing its worth above $2500. XRP, the resurgent underdog, noticed inflows of $2.2 million, the biggest amongst altcoins, and its worth jumped 1%.

The surge in buying and selling volumes throughout the three outstanding cryptocurrencies alerts a convincing resurgence in market exercise. Within a mere 24-hour span, Bitcoin skilled a powerful 40% spike in buying and selling quantity, underlining a notable uptick in investor curiosity.

Ethereum mirrored this enthusiasm with its buying and selling quantity doubling, indicating a big surge in transactional engagement throughout the ecosystem. Not to be outdone, XRP witnessed a unprecedented 90% climb in its buying and selling quantity, additional intensifying the general market dynamics.

Shift In Market Dynamics

This frenetic surge in buying and selling exercise serves as a compelling indicator of a market reawakening, with buyers cautiously repositioning themselves and testing the waters. The palpable anticipation is obvious as buyers hover getting ready to decisive actions, with their fingers poised above the purchase button.

The market appears to be present process a shift, as members actively reply to evolving developments and alternatives, marking a doubtlessly pivotal second within the trajectory of those cryptocurrencies.

Bitcoin at present buying and selling at $42,725. Chart: TradingView.com

But the social gathering isn’t for everybody. Altcoins like Cardano and Solana, as soon as the darlings of the cryptosphere, noticed their inflows dwindle. This selective enthusiasm highlights buyers’ newfound discerning palates, prioritizing established gamers like Bitcoin and Ethereum over the speculative glitter of lesser-known cash.

Geographically, the image is not any much less intriguing. The US, the land of alternative for Bitcoin ETFs, unsurprisingly led the cost with $1.24 billion in inflows. Europe, nonetheless, painted a unique image, with Germany, Canada, and Sweden recording notable outflows.

The jury’s nonetheless out on the long-term influence of spot Bitcoin ETFs. Some consultants anticipate long-term positive factors, whereas others stay cautious, questioning the sustainability of the present rally.

One factor’s for positive: the crypto market has taken a tentative step in direction of Wall Street, however the path forward stays shrouded in uncertainty. Will Bitcoin grow to be a Wall Street darling, or will its attract fade underneath the tough glare of scrutiny?

The subsequent chapter within the crypto saga is simply starting.

Featured picture from Shutterstock