CryptoFees knowledge exhibits that Bitcoin day by day charges averaged $10.65 million from November 16 to November 18, surpassing Ethereum’s common charge of almost $7 million for a similar interval.

Until 2024, the US Securities and Exchange Commission (SEC) is deferring choices on a number of Bitcoin ETF purposes, regardless of the market’s growing optimism in regards to the approval of a spot Bitcoin exchange-traded fund (ETF) within the US.

This hesitation has coincided with a outstanding surge within the prime crypto’s common transaction charges, hovering over 1,000% to achieve a peak of $18.67 on November 16, based on BitInfoCharts knowledge.

The common day by day transaction charges for BTC, totaling $37,370, have seen a reversal with Ethereum. This change comes within the wake of heightened exercise associated to Ordinals on the Bitcoin community.

Bitcoin has outpaced Ethereum in day by day charges within the final 5 days. Source: BitInfoCharts

This fluctuation underscores the dynamic nature of transaction charges within the cryptocurrency house, with Bitcoin experiencing notable shifts in its charge panorama.

Contrary to worries in regards to the potential deterrent impact of elevated transaction charges on Bitcoin customers, on-chain knowledge suggests a contrasting development.

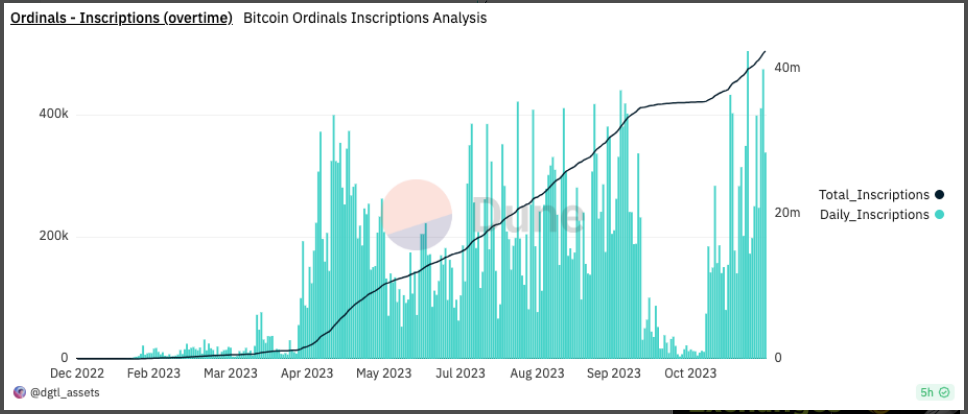

From late October, Ordinals inscriptions elevated by nearly 6 million. Source: Dune Analytics

Widespread Adoption And Growing Addresses

Recent knowledge from IntoTheBlock reveals a notable surge in Bitcoin adoption, hitting a brand new yearly excessive at 67.62% this week.

This enhance in adoption is mirrored within the uptick of newly created energetic addresses, signaling a considerable inflow of recent individuals into the market.

Bitcoin retakes the $37K territory. Chart: TradingView.com

Ordinals Gathering Momentum

Additionally, the quantity of Bitcoin held by long-term buyers has reached an unprecedented excessive, with over 1 million addresses now possessing greater than 1 unit of Bitcoin.

This knowledge signifies a rising and sturdy curiosity in Bitcoin, regardless of issues about transaction charges, as evidenced by each elevated person participation and an increase in long-term holdings.

Since October 24, the community has redistributed roughly 800 BTC in charges, equal to $30 million, on account of the manufacturing of almost 6 million Ordinal property.

Following ORDI’s (the second-largest BRC-20 token by market capitalization) debut on Binance on November 7, the rise in Ordinals inscription actions gathered momentum.

(This website’s content material shouldn’t be construed as funding recommendation. Investing includes danger. When you make investments, your capital is topic to danger).

Featured picture from Freepik