AVAX, native token of the Avalanche community, made a convincing entrance into the cryptocurrency markets on the onset of the 12 months, establishing itself as a outstanding participant and outpacing many different altcoins.

The preliminary enthusiasm surrounding AVAX, nevertheless, underwent a notable transformation because the narrative took an sudden flip. Presently, the token finds itself perched at $36.65, reflecting a marked shift from its earlier bullish trajectory. Over the final seven days, AVAX has encountered a difficult interval, sustaining a 15% loss.

AVAX Downturn Sparks Concerns, Social Silence

The causes behind this latest downturn could possibly be multifaceted, starting from market sentiment shifts to exterior elements influencing broader cryptocurrency tendencies. Investors and market analysts are intently monitoring the state of affairs to discern the underlying dynamics at play and decide whether or not it is a short-term correction or indicative of a extra sustained pattern.

Furthermore, a curious case emerges – the dwindling social quantity. Despite AVAX’s resilience, on-line chatter surrounding the platform has taken a nosedive, elevating questions in regards to the sustainability of the coin.

The diminishing social quantity may recommend a divergence between market efficiency and investor sentiment, prompting a better examination of things influencing each the cryptocurrency’s worth and the notion throughout the group.

Positively, although, the market capitalization of Avalanche has risen by greater than 5% up to now few days, indicating a better inflow of buyers.

AVAX market cap at the moment at $12.647 billion. Chart: TradingView.com

Not too lengthy after Grayscale’s Digital Large Cap Fund adopted the layer-1 blockchain, Avalanche noticed a strong comeback. With billions of cryptocurrency belongings underneath its administration, Grayscale is among the largest digital asset managers.

The inclusion of AVAX in Grayscale’s fund signifies that establishments will nonetheless be serious about Avalanche till 2024 and past.

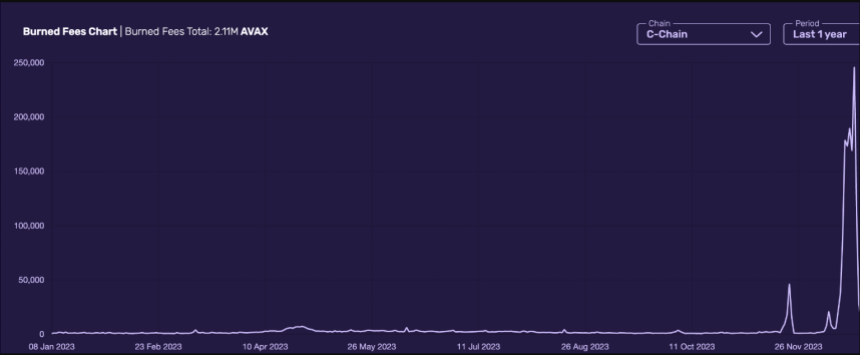

Meanwhile, Avalanche’s circulating provide shrank considerably within the latter half of 2023, fueled by a surge in exercise surrounding “inscriptions.”

Avalanche Surges: Record Token Burns Celebrated

These data-on-chain creations generate transaction charges, that are then completely faraway from circulation by means of the community’s burn mechanism.

Source: AVASCAN

December alone noticed a document 195,000 token burn, a testomony to the rising recognition of inscriptions on Avalanche.

Experts attribute this pattern to a number of elements. Inscription-based transactions, initially common on Bitcoin, are discovering new life on Avalanche attributable to their artistic potential and contribution to the burn mechanism.

This creates a optimistic suggestions loop, attracting customers and additional decreasing the circulating provide. Additionally, the rise of inscription exercise suggests a rising and engaged Avalanche group, which bodes nicely for the community’s long-term well being.

However, the implications of this pattern are nuanced. While token shortage may result in elevated AVAX worth over time, much like Bitcoin, it additionally raises issues about rising transaction charges and potential centralization if giant inscription tasks management a good portion of the price pool.

Featured picture from Shutterstock

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this web site totally at your personal threat.