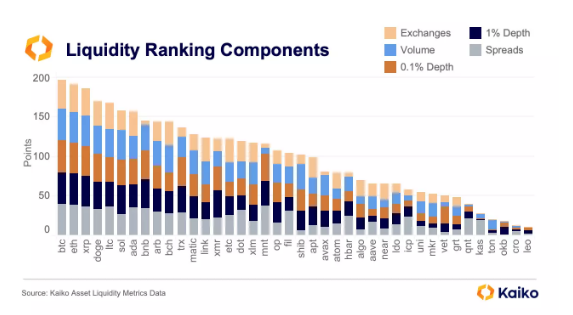

Kaiko, a blockchain analytics platform, performed an investigation that exposed the complexities of liquidity throughout the most important crypto property, with some decrease market cap property beating larger ones. According to its Q3 liquidity rankings, XRP and Dogecoin (DOGE) managed to beat out Solana and Cardano in liquidity rankings, coming in behind solely Bitcoin and Ethereum. There had been additionally some shock numbers on the rankings, like BNB coming in eighth by way of liquidity, and Litecoin additionally outperforming.

Kaiko Analysis Highlights Liquidity For Crypto Assets

The huge variety of crypto property has all the time introduced out the concept amongst traders to rank their valuation on a scale of some kind, with probably the most adopted being the market cap. However, in response to Kaiko, liquidity, together with different metrics like quantity and market depth is a greater option to measure a token’s actual worth other than its market cap. This was greatest demonstrated by FTX’s token FTT, whose market was bloated to succeed in a peak of practically $10 billion with out having sufficient liquidity on exchanges to again this up.

According to its newest rankings, Bitcoin took up the primary spot in liquidity. This wasn’t stunning, as Bitcoin has all the time held a decent reign over the crypto business since its inception. Ethereum adopted in second place by way of liquidity to reiterate its place because the king of altcoins. However, Kaiko’s liquidity rankings began to digress from the market cap on the third place, with BNB underperforming massively to return in at eighth place.

Instead, XRP got here in at 4th place, beating out the likes of Solana and Cardano (the Ethereum killers) on exchanges amongst merchants. XRP’s liquidity enhance within the quarter was due to the asset receiving regulatory readability within the US. Dogecoin got here in at fifth place, regardless of being tenth on market cap rankings, to solidify its place because the chief amongst meme cash. Litecoin got here in at fifth place to finish the highest 5, regardless of being 18th in market cap rankings.

Total crypto market cap at $1.59 trillion on the day by day chart: TradingView.com

On the opposite hand, AVAX’s liquidity rating dropped 11 locations when in comparison with its market cap, whereas TON got here in at thirty seventh place regardless of being ninth by market cap in the course of the quarter. Also, ATOM, UNI, APT, TON, SHIB, OKB, LEO, and CRO all fell greater than 5 spots.

What Does Liquidity Say About Dogecoin And Crypto Assets?

Kaiko’s measure of liquidity included the unfold and the common day by day buying and selling quantity on totally different exchanges. The analytics platform additionally included two totally different market depth ranges; 0.1% for larger frequency merchants and 1% for longer-term holders.

In phrases of buying and selling quantity, BTC got here in first place whereas ETH and XRP adopted swimsuit. However, SOL beat DOGE on this metric with round $2 billion within the quarter.

The backside line is that larger liquidity usually precedes larger success over the long run for cryptocurrencies. This autumn 2023 ought to inform a robust story by way of crypto liquidity, as most cryptocurrencies registered new yearly highs by way of market cap.

Featured picture from Shutterstock

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your individual analysis earlier than making any funding selections. Use info supplied on this web site completely at your individual threat.