Ethereum (ETH), the second largest cryptocurrency by market cap, skilled a worth drop of over 3% throughout the final 24 hours. The motive is presumably a big sell-off carried out by a outstanding whale. The whale deposited 25,000 ETH (value round $47.24 million) on Binance, solely to withdraw a big quantity of USDT shortly afterwards.

As the on-chain knowledge supplier Lookonchain reports, the whale has in all probability already offered part of his ETH. According to the on-chain knowledge, the whale withdrew 16 million in USDT. “The drop in ETH price [a few hours] ago was most likely due to the sell-off of this whale,” the analysts notice, additional explaining that the whale nonetheless owns round 8,000 ETH ($14.7 million) unsold.

Nevertheless, ETH bulls proceed to indicate energy. A take a look at the 1-hour chart of Ethereum reveals that the value has fashioned a bull flag. In technical evaluation, a flag is a short-term consolidation sample that happens after a robust worth transfer and signifies a brief break within the pattern.

A bullish flag types throughout an uptrend with the flagpole pointing upwards, adopted by a consolidation section earlier than a potential continuation of the upward motion. For now, the sample has held, ETH has bounced up from the 4H 200 EMA at $1,825. In this respect, the bulls stay in management (regardless of the whale) in the interim.

Basically, two eventualities are conceivable. If the aforementioned help ranges are damaged to the draw back, particularly the underside of the flag, Ethereum might face an additional worth decline in direction of $1,750. Conversely, a breakout from the flag sample to the upside (round $1,900) might set off a worth rise in direction of $2,000.

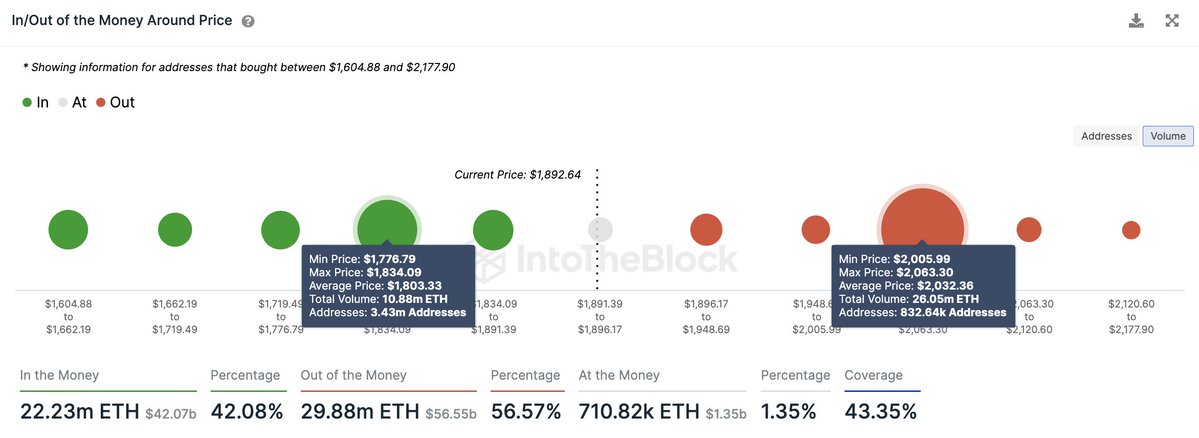

However, in line with analyst Ali Martinez, that’s the place the value will hit Ethereum’s key provide wall, which is within the $2,000 to $2,060 vary, the place 832,640 addresses have purchased over 26 million ETH. “If ETH can break through this resistance barrier, we can expect an upswing to $2,330 or even $2,750,” Martinez believes.

Ethereum Options Expiry On Friday Confirms Outlook

The most necessary occasion this week for Bitcoin, Ethereum and all the crypto market would be the expiration of over $7 billion in choices tomorrow, Friday, June 30. The present choices quantity on the biggest alternate Deribit is 14,107 calls, 9,445 places and a put-call ratio of 0.67 for Bitcoin. For Ethereum, there are at the moment 76,776 calls, 39,779 places and a put-call ratio of 0.52.

Options Volume [Deribit]$BTC: 📈Calls=14,107.70, 📉Puts=9,445.50, ⚖️Put-call ratio=0.67 $ETH: 📈Calls=76,776.00, 📉Puts=39,779.00, ⚖️Put-call ratio=0.52

— coinoptionstrack bot (@optionstrackbot) June 29, 2023

A put-call ratio under 1 usually signifies that the variety of name choices is larger than the variety of put choices, which signifies a extra bullish market sentiment. In this case, the put-call ratio for ETH is 0.52, which signifies that there are extra name choices in comparison with put choices. Thus, the ratio signifies that market members are extra susceptible to bullish bets on the ETH worth.

Featured picture from iStock, chart from TradingView.com