The Ethereum value has adopted Bitcoin’s lead and has seen a ten.3% value improve over the previous seven days. News of BlackRock’s Bitcoin spot ETF submitting with the US Securities and Exchange Commission took all the market abruptly and likewise breathed new life into altcoins. For one dealer on the decentralized perpetual alternate GMX, nonetheless, the information shouldn’t be actually excellent news, however slightly a nightmare.

Ethereum Short Seller Getting Rekt?

The largest brief vendor on GMX is utilizing 6.64x leverage to brief Ether (ETH) at an entry value of $1,703.97. A complete of $1.8 million of collateral is at stake for the nameless dealer. At press time, the place was down 77.4% for a complete of -$1.416 million.

As it stands, the dealer’s brief place of about $12 million in ETH might be liquidated when the Ethereum value reaches $1,945.18. According to a report from Chinese journalist Colin Wu, it could possibly be the proprietor of rebelvarma.lens.

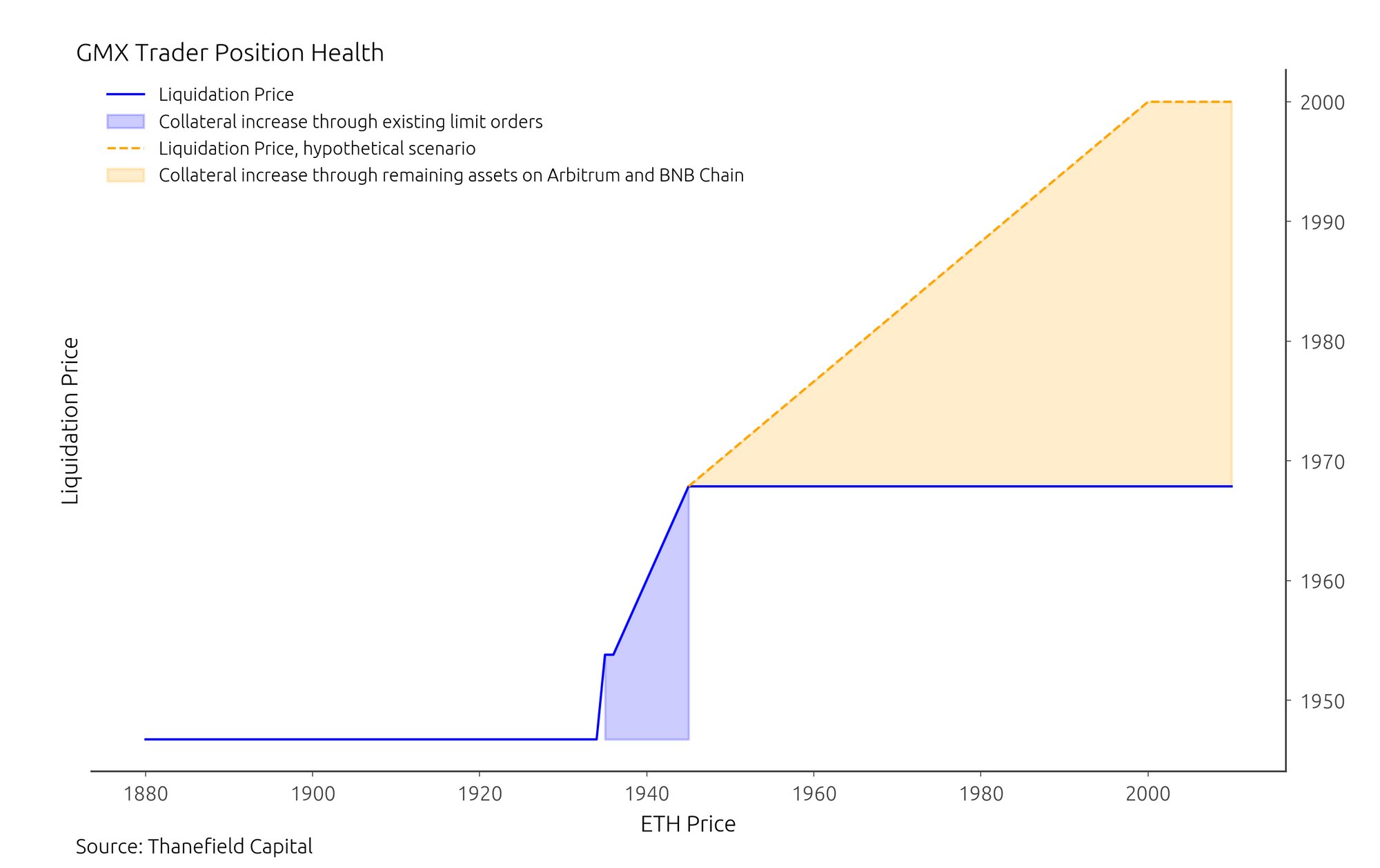

As widespread analyst An Ape’s Prologue speculates, the ETH brief vendor might even double down on his guess. As the analyst writes, the consensus assumes that the brief place might be liquidated when ETH reaches $1945. However, there are restrict orders that might add a complete of $149,000 to the dealer’s collateral throughout the $1935 and $1945 value vary. If triggered, this might improve the liquidation value to round $1967.

The analyst’s chart under reveals how his liquidation value modifications with ETH value swings. Until Ethereum reaches $1935, the liquidation value stays at $1945, however restrict orders are triggered when ETH enters the $1935 and $1945 vary, rising the liquidation value to $1967.

In addition, the analyst notes that the tackle holds about $224,000 price of different belongings unfold throughout Arbitrum and the Binance Smart Chain: $90,000 in USDT, $51,000 in USDC, $64,000 in WBTC and $21,500 in AAVE.

“With a history of mitigating liquidation risk by bridging tokens from other chains to Arbitrum for collateral, we’ll probably see a similar strategy if ETH prices increase. The $224k in available assets could be used to top up collateral in this scenario,” the analyst notes.

If the ETH brief vendor makes use of up all of its belongings and places them up as collateral, the utmost liquidation value might rise to round $2,000, representing an additional 6.5% value improve from the present value. Hence, Twitter person @apes_prologue concludes:

While his place seems dangerous, the hazard of liquidation shouldn’t be as imminent as popularly believed, as he has mechanisms at his disposal to guard his place. Additionally, additionally it is potential he might have hedged his place in different markets that we’re unaware of.

ETH On The Verge Of Breaking Above $2,000?

Rumors are circulating within the crypto neighborhood that the liquidation of the GMX short-seller might set off a breakout of ETH above $2,000. The 1-hour chart of Ether reveals that the worth is at present caught within the value vary between $1,964 and $1,930 for the second. A breakout to the upside or draw back could possibly be decisive for the following transfer.

A have a look at the 1-day chart reveals {that a} breakout above $1,930 doesn’t essentially imply a follow-through to above $2,000. The 78.6% Fibonacci retracement degree is at $1,975, the place main resistance is predicted. Ethereum bulls can solely goal the psychologically necessary $2,000 degree in the event that they get away above this value degree.

Featured picture from iStock, chart from TradingView.com