The Spot Bitcoin ETFs have lived as much as the hype, as these funds have ramped up institutional adoption of the flagship cryptocurrency, Bitcoin. This is additional evident in a current evaluation that captured how a lot Bitcoin BlackRock and different issuers amassed on this week alone.

Spot Bitcoin ETF Issuers Purchased Over 19,908 BTC This Week

Data from the on-chain analytics platform Lookonchain reveals that the Spot Bitcoin ETF issuers mixed to buy over 19,908 BTC ($860 million) this week. Meanwhile, it’s price mentioning that Lookonchain’s information didn’t seize WisdomTree’s BTC purchases in its evaluation, suggesting that the determine could possibly be means increased when the asset supervisor’s purchases are additionally factored in.

Further information obtained from Arkham Intelligence supplied insights into how a lot Bitcoin Wisdom Tree obtained for its Bitcoin fund this week. 74 BTC is proven to have gone into the asset supervisor’s pockets deal with for its Spot Bitcoin ETF. The addition of those crypto tokens signifies that all Spot Bitcoin ETF issuers mixed to buy nearly 20,000 BTC this week alone.

Interestingly, Bitcoin ETFs had been not too long ago reported to carry 3.3% of Bitcoin’s circulating provide, underscoring their success since launching. Data from Lookonchain reveals that these ETFs presently maintain over 657,000 BTC (excluding WisdomTree).

Matt Hougan, Bitwise’s Chief Investment Officer (CIO), additionally revealed how these funds have seen flows of $1.7 billion after their first 14 buying and selling days. This is extra spectacular as he made a comparability to Gold ETFs, which noticed $1.3 billion in an analogous time-frame. In one other X put up, he talked about how these Spot Bitcoin ETFs have taken $700 million in web inflows this week alone.

BTC value recovers above $43,000 | Source: BTCUSD on Tradingview.com

BlackRock Finally Trumps Grayscale

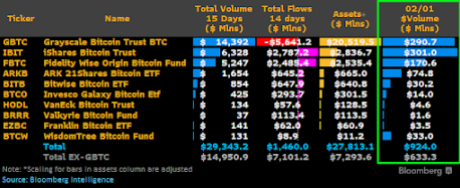

Bloomberg analyst James Seyffart talked about in an X put up that BlackRock’s IBIT seems to have change into the primary ETF to commerce greater than Grayscale’s GBTC in a single day. Before now, Grayscale had continued to file probably the most each day buying and selling quantity, though IBIT had come shut on a few events.

From the info that Seyffart shared, IBIT seems to have recorded $301 million in buying and selling quantity on February 1, whereas GBTC noticed $290 in buying and selling quantity. However, he additional said that the whole buying and selling on the day “was kind of a dud,” with all Spot Bitcoin ETFs mixed recording $924 million in buying and selling quantity.

Interestingly, that occurred to be the primary day that the each day quantity for Spot Bitcoin ETFs was below $1 billion. The Bloomberg analyst didn’t, nevertheless, give any opinion as to what may have triggered this comparatively sub-par efficiency.

Featured picture from U.S. Global Investors, chart from Tradingview.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your individual analysis earlier than making any funding choices. Use data supplied on this web site solely at your individual threat.