Renowned analyst Josh Olszewicz has shared some compelling insights on Ethereum’s value trajectory. Drawing parallels from historic patterns, Olszewicz’s analysis means that Ethereum is likely to be gearing up for a major rally within the coming months.

Historical Pattern: Ethereum Forms Ascending Triangle

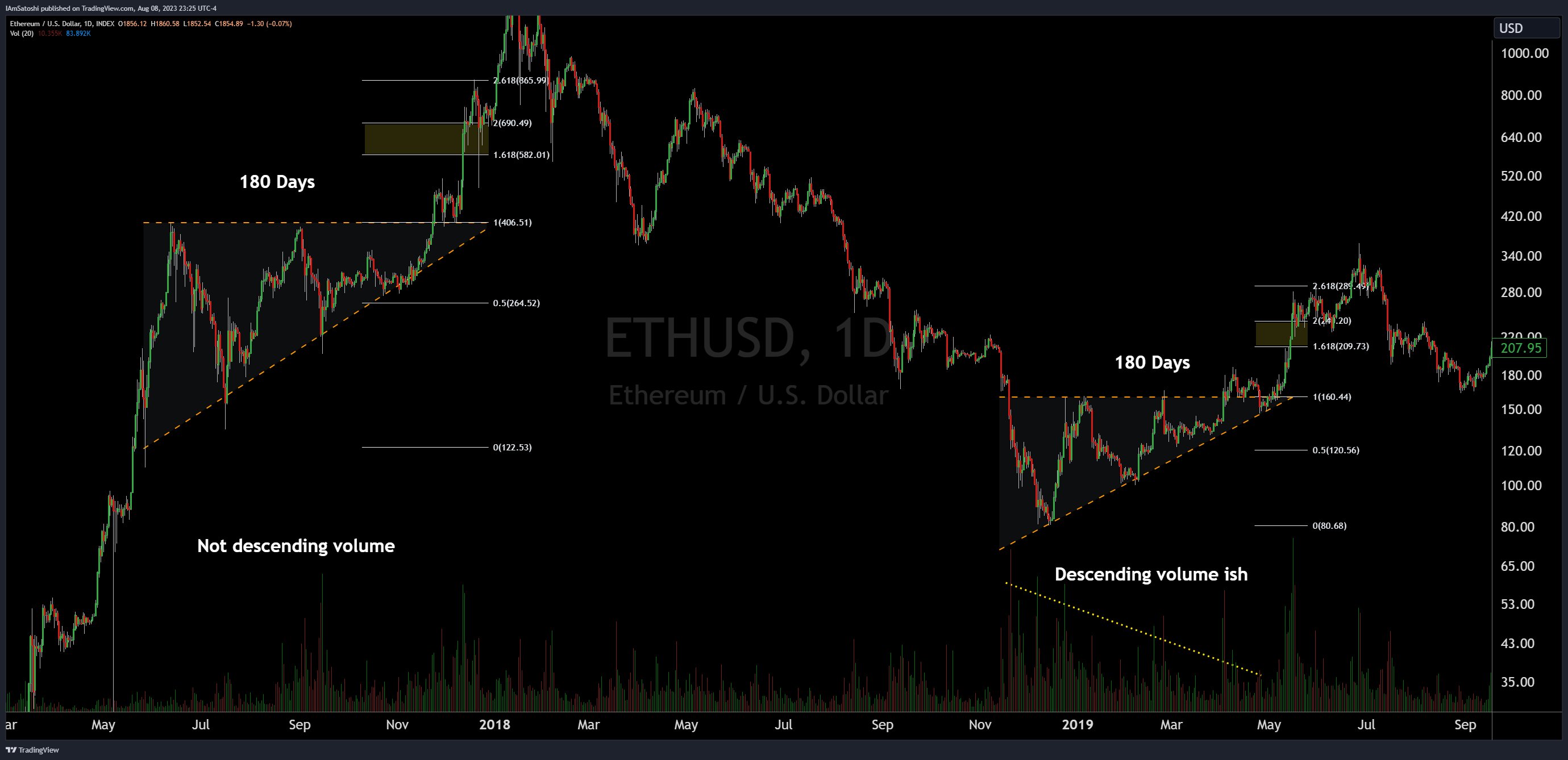

Olszewicz begins by highlighting Ethereum’s present value sample, jokingly stating, “Ethereum: ascending triangle 450 million years in the making w/fib extensions to $3k.” This ascending triangle, characterised by a flat high and rising backside, has been forming since May 2022, and if historical past is any information, it may very well be a bullish signal for Ethereum.

Descending quantity, one other function of this sample, additional strengthens the bullish bias. However, Olszewicz cautions that the “bias remains bullish until price breaks below diagonal support.” He additionally factors out the psychological resistance at $2,000, noting it as an “extremely obvious signal that it’s go time, which should help the breakout.”

To bolster his evaluation, Olszewicz attracts parallels from Bitcoin’s previous. He recollects, “take BTC in 2015/2016 [the price formed an ascending triangle for 210 days with descending volume] and BTC in 2018/2019 [ascending triangle for 130 days with descending volume] as examples.” In each cases, Bitcoin surged in direction of the Fibonacci extension ranges submit the breakout.

Ethereum itself isn’t a stranger to such patterns. Olszewicz cites, “ETH has also had previous examples in 2017 (bullish continuation) and 2019 (bullish reversal).” Each ascending triangle sample lasted 180 days. Both instances ETH surged in direction of the two.618 Fibonacci extension degree.

Drawing from these historic patterns, Olszewicz means that Ethereum is at the moment holding the potential to overshoot the 1.618 Fibonacci degree and presumably attain the two.618 degree, which interprets to a value of $3,800. However, he properly advises, “but don’t get out the imaginary profit calculator just yet, let’s break $2k first.”

ETH vs. BTC: Which One Is The Better Trade?

While Ethereum’s potential rally is intriguing, Olszewicz additionally delves into its efficiency relative to Bitcoin. He observes that Ethereum has underperformed Bitcoin year-to-date, attributing this to the ETF narrative and Bitcoin’s dominance as exhausting cash. He speculates, “the better trade may continue to be BTC/USD, especially with initial spot ETF inflows favoring BTC.”

However, if the ETH/BTC pair can break and maintain new highs, it’d trace at a runaway commerce for Ethereum. But Olszewicz stays skeptical, stating it’s “unlikely based on ETF flows.”

Olszewicz additionally doesn’t draw back from discussing potential bearish eventualities. He’s carefully watching sure bearish ETH/BTC ranges, together with the present native low at 0.050 and the earlier inverse head and shoulders neckline at 0.039.

For Bitcoin, he suggests a possible transfer to $42,000, offered it maintains sure bullish situations. He notes, “as long as we can maintain prices above the midline of the PF & stay in the cloud, we have a decent shot at reaching $42k before halving.”

Wrapping up his evaluation, Olszewicz envisions a dream commerce the place Bitcoin breaks bullish first, presumably as a consequence of technicals or a spot ETF approval. In this state of affairs, Ethereum breaks $2,000 however lags behind Bitcoin, resulting in ETH/BTC getting “crushed, allowing for an eventual profit taking rotation from Bitcoin to Ethereum”. However, he concludes with a phrase of warning: “without inflows, we ain’t movin.”

At press time, ETH traded at $1,860.

Featured picture from iStock, chart from TradingView.com