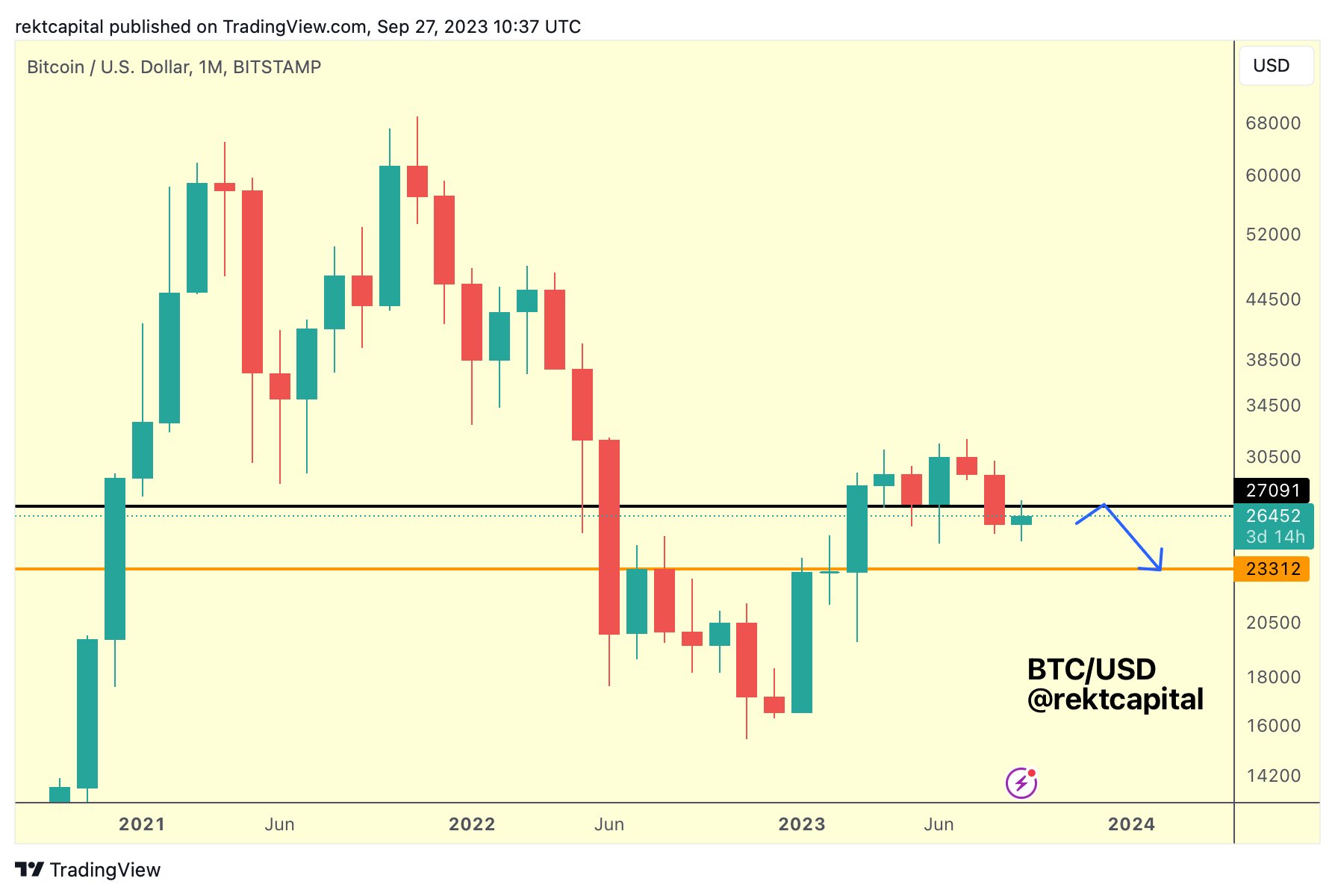

Renowned crypto analyst Rekt Capital has not too long ago highlighted the pivotal nature of the Bitcoin value’s imminent month-to-month candle shut. In an announcement by way of X (previously Twitter), he detailed that Bitcoin has tagged the $27,000 month-to-month degree from the underside, that means it’s performing as resistance in the intervening time.

He defined that “the upcoming monthly candle close is just around the corner. Bitcoin needs to monthly close above $27,091 for this to be a fake-breakdown. Otherwise, the breakdown will be technically confirmed.”

To give this assertion some historic context, the previous month – August – noticed a major improvement for the flagship cryptocurrency. BTC registered a bearish month-to-month candle shut, ending under roughly $27,150. This knowledge level, based on Rekt Capital, successfully confirmed it as misplaced help.

Reflecting on this improvement on the time, the analyst had conveyed that it’s attainable BTC might surge to $27,150, “maybe even upside wick beyond it this September. But that would likely be a relief rally to confirm $27150 as new resistance before dropping into the ~$23000 region. $23000 is the next major Monthly support now that ~$27150 has been lost.”

Is Bitcoin Following Historical Patterns?

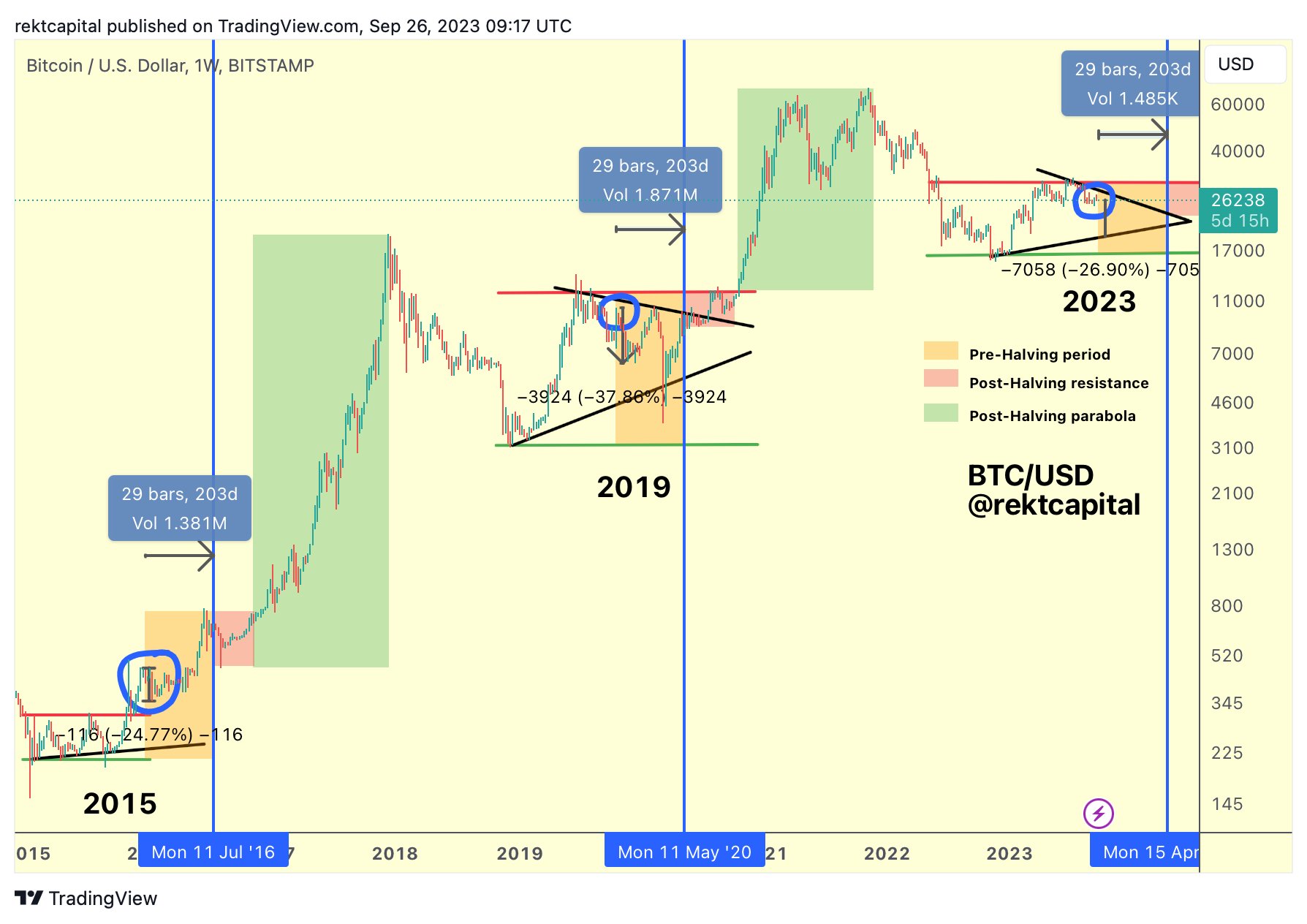

Rekt Capital’s observations about Bitcoin aren’t made in isolation however are deeply rooted in Bitcoin’s historic value and cycle behaviors. Drawing parallels to earlier patterns, he had beforehand make clear Bitcoin’s tendencies round 200 days earlier than a halving occasion.

“At this same point in the cycle (~200 days before the halving): In 2015, Bitcoin retraced -24% within a re-accumulation range, but price consolidated for months going into the halving. In 2019, Bitcoin retraced -37% as part of a downtrend that continued for months going into the halving.”

These historic retracements at the same juncture have given rise to 2 important insights, as said by Rekt Capital. First, a direct retracement has occurred at this similar level within the cycle. Second, a repeated retrace of between -24% to -37% in 2023 would lead Bitcoin to retest its macro greater low, probably pushing its value below the $20,000 threshold.

The analyst didn’t cease there. Accentuating the perfect accumulation phases for traders, he famous, “The best time to accumulate Bitcoin was in late 2022 near the bear market bottom. The second best time to accumulate Bitcoin is upon a deeper retracement in the pre-halving period.”

Shifting the main target to potential future outcomes, Rekt Capital made an intriguing hypothesis in regards to the potential of BTC’s value motion post-halving: “If ~$31000 was the top for 2023. Then the next time we see these prices will be months from now, just after the halving. Only difference between now and then? In this pre-halving period, BTC could still retrace from here. But after the halving, BTC would break out much higher from current prices.”

To summarize, the upcoming month-to-month candle shut for Bitcoin might have profound implications for the asset’s short-to-mid-term trajectory. All eyes will now be on whether or not BTC manages to shut above or under the vital $27,150 mark – an indicator that might both verify a technical breakdown or prevail over a traditionally untypical value rally.

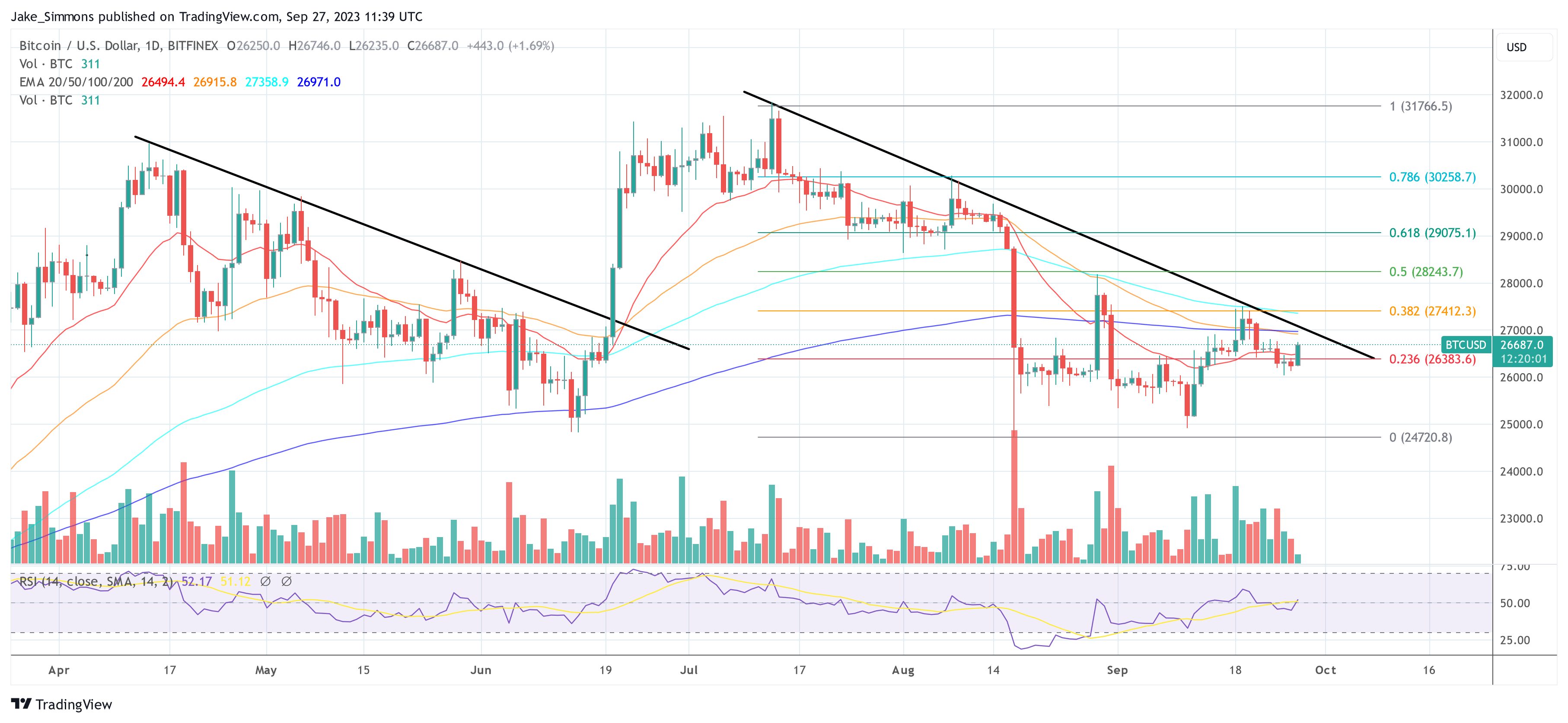

At press time, BTC stood at $26,687.

Featured picture from Shutterstock, chart from TradingView.com