On-chain knowledge exhibits Ethereum whales have offered round 12 million within the cryptocurrency throughout the previous 12 months and have proven no indicators of slowing down.

Ethereum Whale Holdings Have Been In Constant Downtrend Since 2020

In a brand new post on X, analyst James V. Straten has mentioned how the Bitcoin and Ethereum whales have proven some stark distinction of their habits.

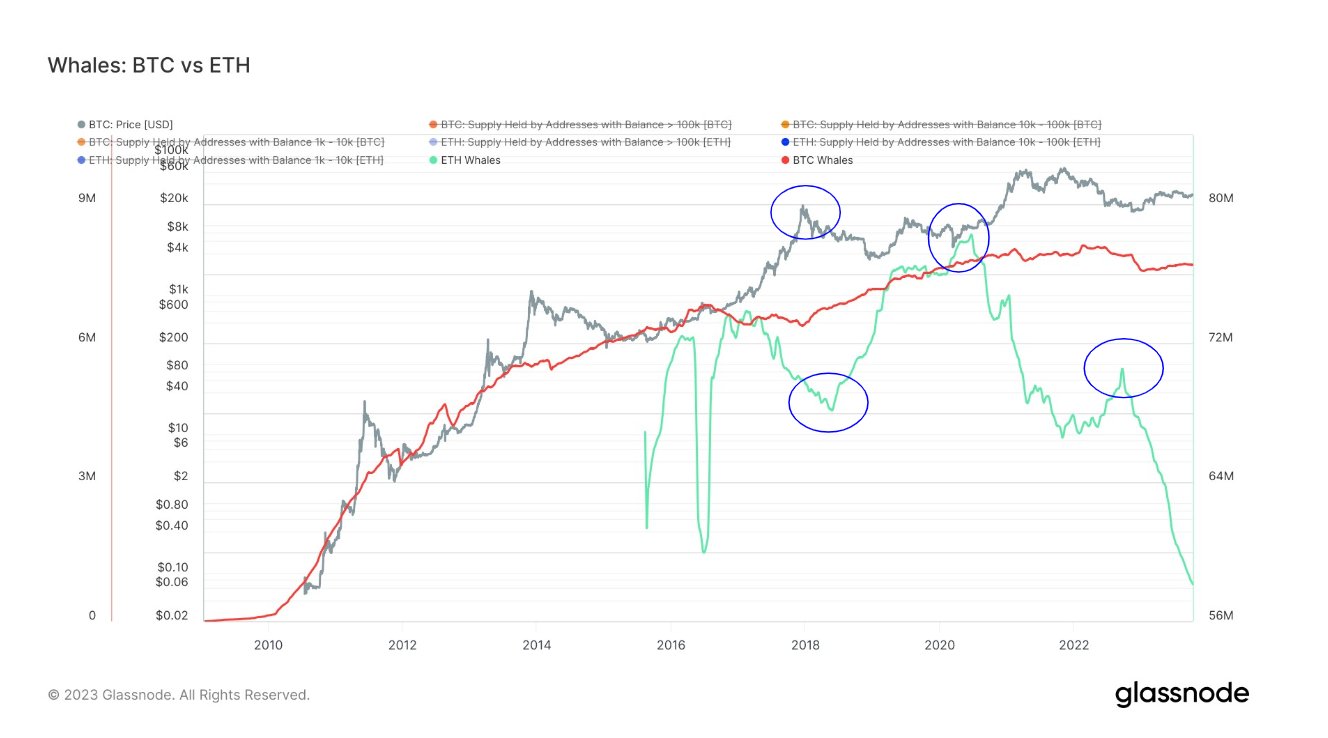

Here is the chart that the analyst has shared, which compares the traits within the holdings of those humongous holders for the 2 belongings over their total historical past:

How the holdings of the whales differ between the 2 cryptocurrencies | Source: @jimmyvs24 on X

For defining what a “whale” is, the analyst has chosen the 1,000 tokens cutoff for each belongings. The graph exhibits that the holdings of the Bitcoin whales have been in an general uptrend all through the asset’s historical past.

Some deviations have been from this upward trajectory, like through the 2021 bull run, the place these traders participated in some profit-taking. However, such deviations have solely been momentary because the whales have finally resumed their accumulation.

However, a deviation that’s but to be reversed totally is the drawdown noticed across the FTX collapse in November 2022. Nonetheless, the whales have participated in some accumulation for the reason that begin of the 12 months; extra is required to retrace the aforementioned plunge.

The Bitcoin whales have seen their holdings transfer sideways up to now couple of years. The Ethereum whales, alternatively, have participated in a steep selloff throughout the identical interval.

Since 2020, these holders have shed 20 million ETH from their mixed holdings, price about $31.6 billion on the present trade fee. In the previous 12 months alone, they’ve offered about 12 million ETH ($18.9 billion), an astonishing determine.

As highlighted within the graph, the Ethereum whales confirmed a brief deviation part once they purchased on the bear market lows. Nevertheless, this accumulation was shortly reversed because the indicator resumed a pointy plunge quickly after.

Something price noting right here is that the scale of the whales isn’t the identical between the 2 belongings. Due to the distinction within the costs of the cash, 1,000 tokens of every have vastly totally different weightages. Based on this cutoff, Bitcoin whales would maintain at the least $27.4 million price of the asset, whereas the ETH whales maintain simply $1.58 million.

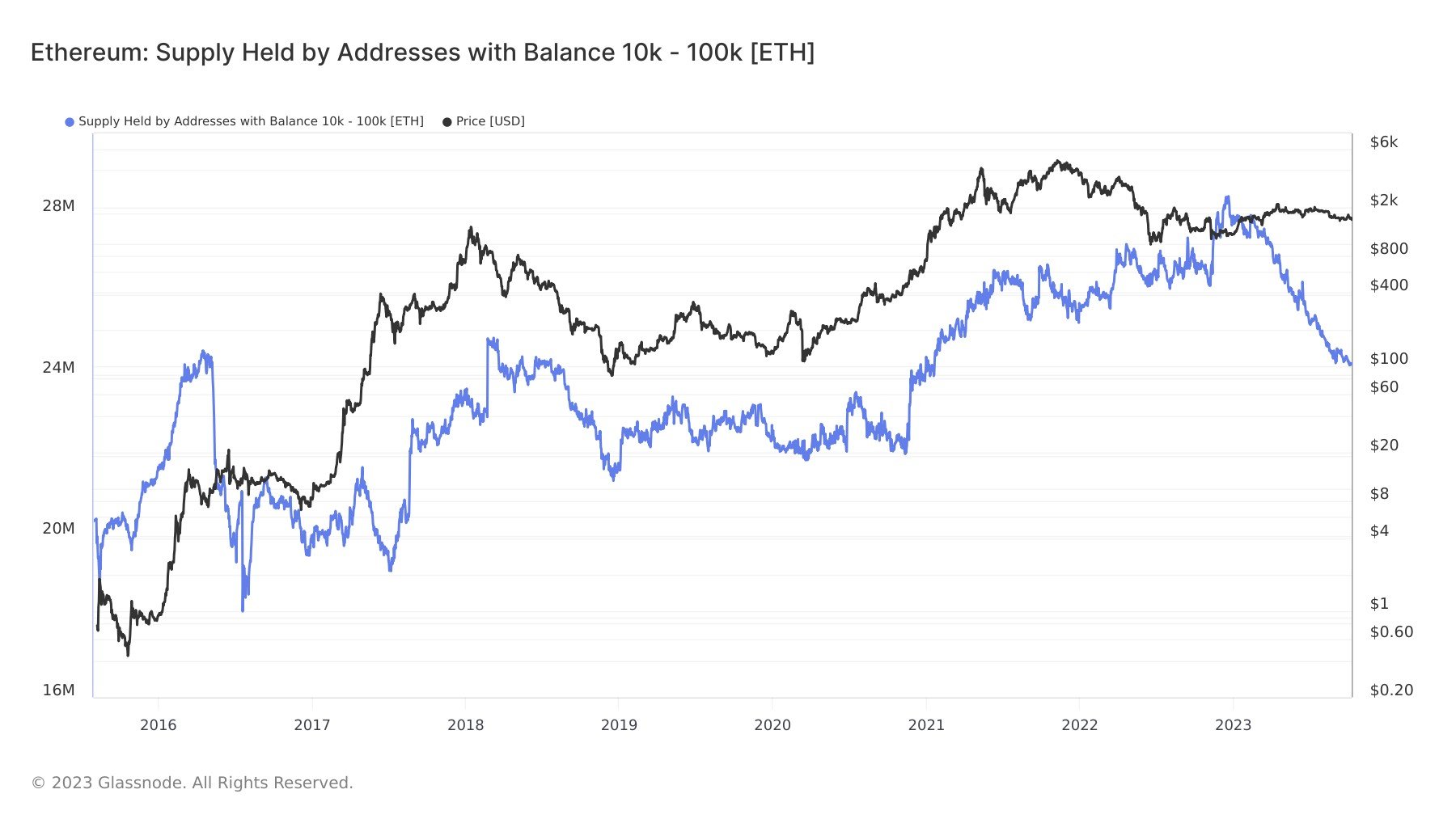

A extra truthful comparability could also be made by trying on the holdings of the ETH entities of comparable dimension to the BTC whales. As displayed within the chart beneath, the Ethereum whales with between 10,000 to 100,000 ETH ($15.8 million to $158 million) have proven accumulation through the years. Still, this cohort has additionally offered large quantities this 12 months.

Looks like the worth of the metric has sharply declined lately | Source: @jimmyvs24 on X

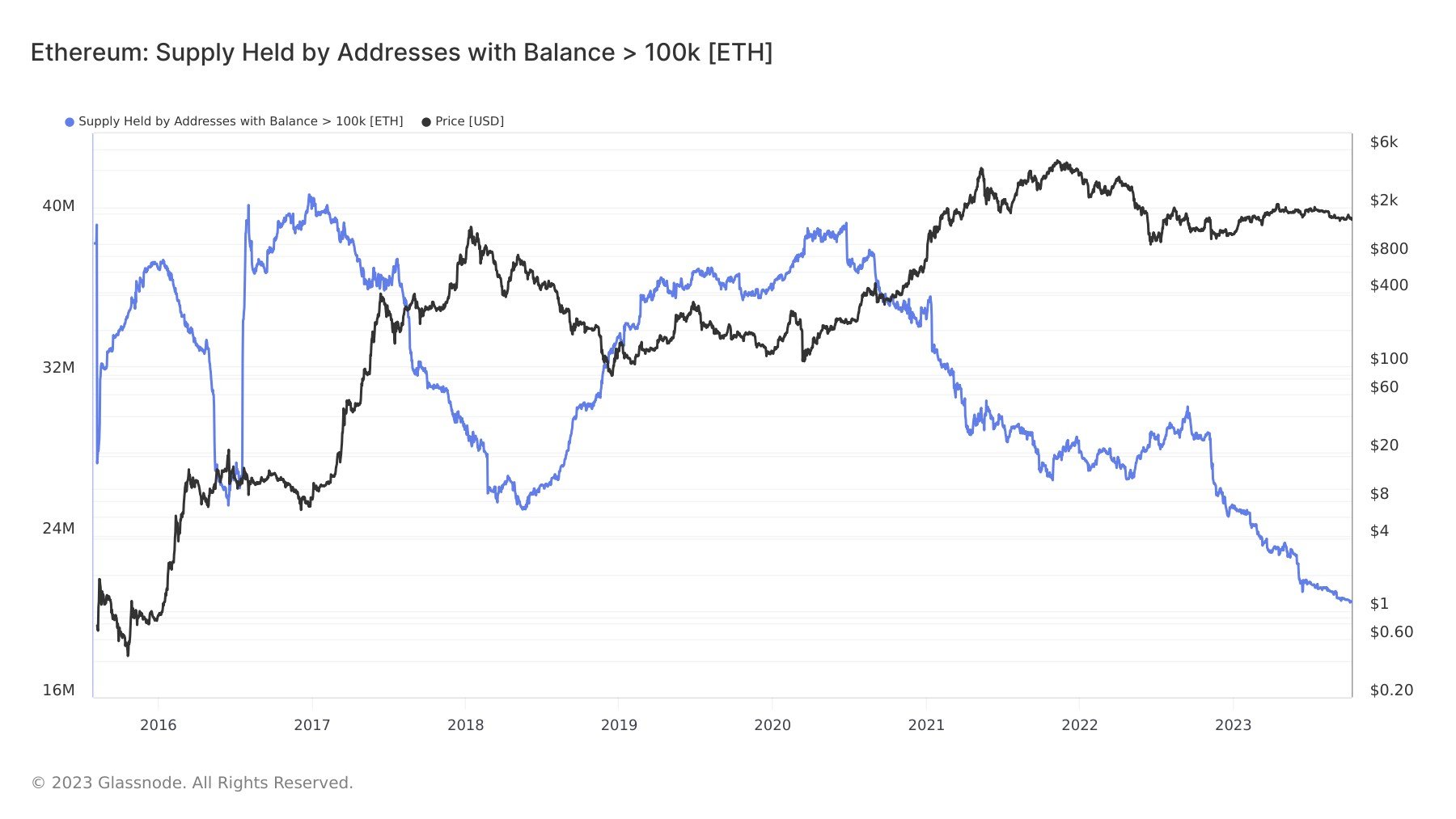

However, the mega whales on the community ($158 million+) have proven habits extra in step with the combination 1,000+ ETH group, as they’ve distributed closely since 2020.

These whales have been promoting for a couple of years now | Source: @jimmyvs24 on X

Ethereum’s state of affairs appears bleak, at the least when it comes to the holdings of the whales. The indisputable fact that these humongous holders have proven no indicators of a turnaround to date would be the most regarding, as they lack curiosity in accumulating the asset. This differs tremendously from the sentiment across the Bitcoin whales, who’ve been taking part in internet shopping for this 12 months.

ETH Price

Ethereum has registered some decline lately, because the coin’s worth is now retesting the identical lows as again in August.

ETH has been transferring sideways over the previous couple of months | Source: ETHUSD on TradingView

Featured picture from Shutterstock.com, charts from TradingView.com, Glassnode.com