Kokusai Electric Corp, a Japanese chip equipment maker, is hiring in China in a transfer to increase the 66% rally in inventory costs it noticed after its IPO in October, experiences Bloomberg.

The anticipated growth in China comes down, partly, to the USA implementing tighter export rules on home chip producers exporting to China. Kokusai Electric Corporation manufactures and distributes semiconductor manufacturing methods.

“Countless small-scale fabrication plants are springing up like mushrooms in China,” mentioned Kokusai’s CEO Fumiyuki Kanai, in an interview with Bloomberg. “The Chinese government is providing aggressive support to the industry for activities including the internet-of-things, smartphones, and personal computers, ” he continued.

Kanai, who dealt with the Tokyo-based firm’s IPO, believes that China holds continued worth for Kokusai and that growing the corporate’s assist workers there’ll higher serve shoppers. He additionally mentioned that after investments for manufacturing and next-generation device growth, he’ll concentrate on shareholder returns, and can actively contemplate inventory buybacks.

The Chinese chip market

“We have locations in China only to provide after-sale services and have no plans to do production or research there,” Kanai mentioned. “We will increase personnel to cover the local demand.”

The Chinese market accounts for 40% of the chip gear maker’s income, with the expectation that this may rise to 50% within the close to future.

As a results of strict export rules from the USA, Chinese chip gear producers had been witnessing a surge in gross sales. However, newer information means that the market will not be as secure because it appeared, with over 22,000 chip-related corporations shutting their doorways in 2023. This is partly as a result of a decline in demand attributable to market adjustments as a result of Covid.

The most at-risk corporations are the smallest ones which battle to safe investments, and with their established place out there, Kokusai is probably going hoping to soak up among the demand launched by closing opponents. Kanai additionally said that the corporate is seeking to diversify into areas that complement its present vary.

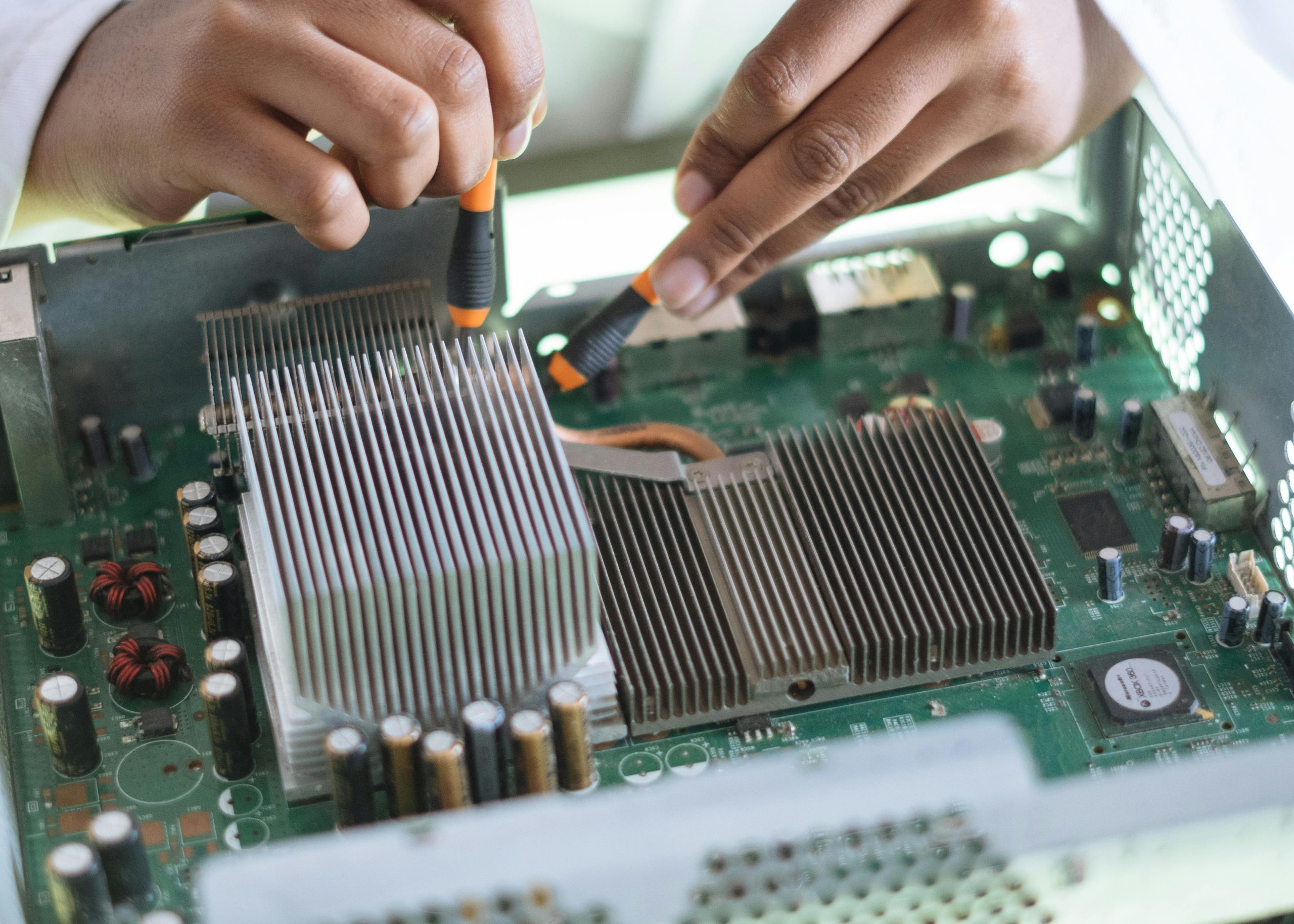

Featured picture: RF._.studio/Pexels