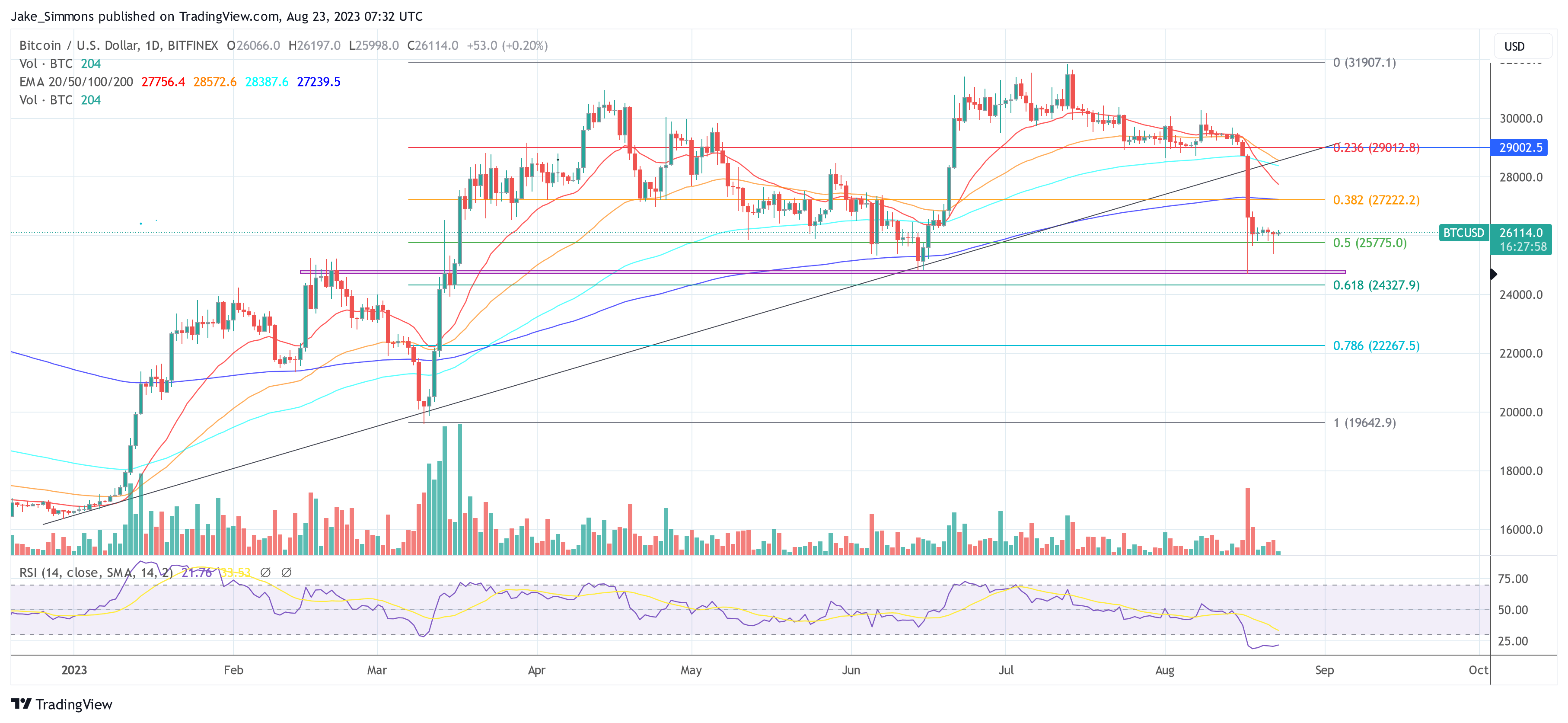

As the Bitcoin market navigates the uneven waters round $26,000, there are a number of metrics to keep watch over. After hitting a low of $25,374 yesterday, the bulls have managed to push the worth again up, though the market stays in a susceptible state following final Thursday’s worth crash.

Currently, the Fear and Greed Index for Bitcoin sits at 37, which is indicative of robust concern permeating the market. Typically, such a low degree on this index means that market individuals are apprehensive in regards to the near-term future, usually resulting in a self-fulfilling prophecy of kinds the place the promoting strain will increase.

An In-Depth Look At Bitcoin CVDs & Delta

Renowned analyst Skew has highlighted the position of Cumulative Volume Delta (CVD) in understanding the present market dynamics at present. “BTC Aggregate CVDs & Delta reveal limit spot sellers here with shorts pushing for control.” This signifies that at the same time as merchants want to purchase at market costs (takers), these keen to promote are setting limits, including a ceiling to any short-term bullish momentum.

The particular worth level to notice right here is $26,100. “This level has acted as a magnet for limit sellers,” Skew notes, “and is backed by the pattern seen in spot CVD versus price so far.” In different phrases, spot takers are being absorbed by restrict sellers at this worth, constraining upward motion.

Perpetual CVD (Perp CVD) additionally deserves consideration because it “moves lower in line with longs closing out and new shorts coming in.” This means that merchants will not be solely masking their lengthy positions but additionally opening new quick positions, according to the present bearish worth motion.

Examining particular exchanges like Binance and Bybit provides additional granularity to the evaluation. According to Skew, “Longs got rinsed in that sweep below $25,800, thereby marking that level as a key pivot point.” Open Interest (OI) on Binance noticed a discount of 6,000 BTC, and Bybit OI was down by 3,000 BTC – all in lengthy positions that had been liquidated.

The liquidation of longs at these ranges presents a transparent danger for any bullish eventualities. “Clear risk for longs is below $25,800,” Skew asserts, making it a vital degree to observe for merchants who’re internet lengthy.

MacroCRG, a famend market analyst, added to the evaluation that giant quantity of longs had been liquidated once more throughout yesterday’s BTC dip: “More pain for #Bitcoin longs as another $300M+ of open interest was wiped out overnight by a downside sweep. When will it end?”

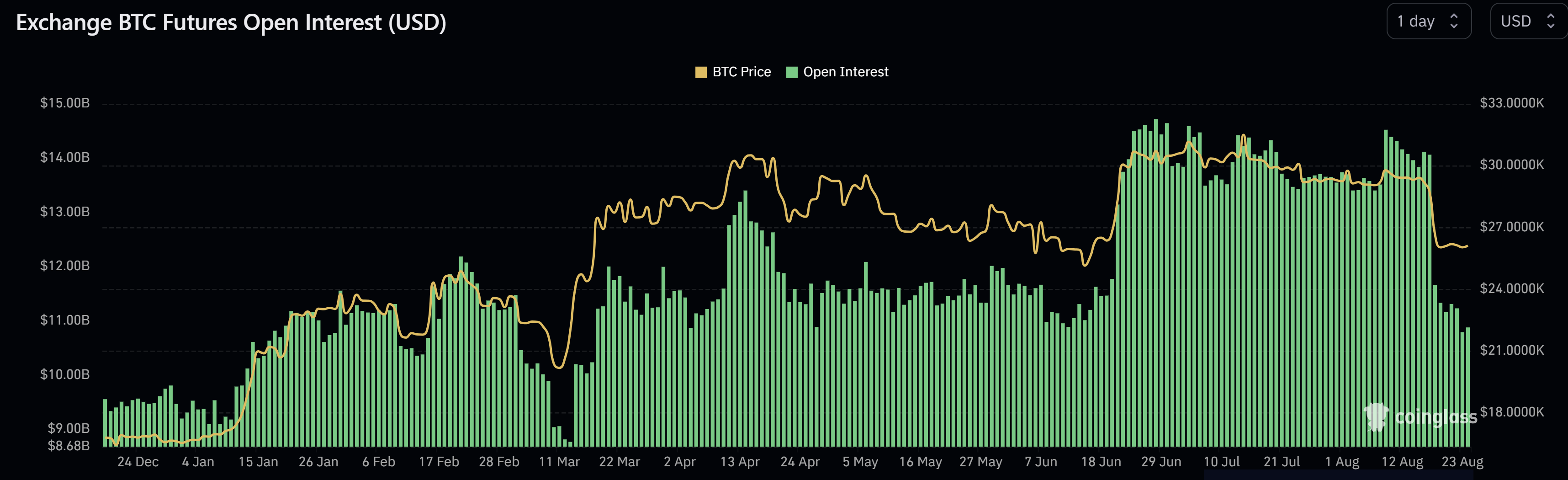

However, there might be a silver lining, as Skew places it: “Likely to see apes rage shorting this soon.” But up to now, Bitcoin’s open curiosity (OI) stays flat after Thursday’s flush. OI at the moment stands at $10.88 billion (after being above $14 billion).

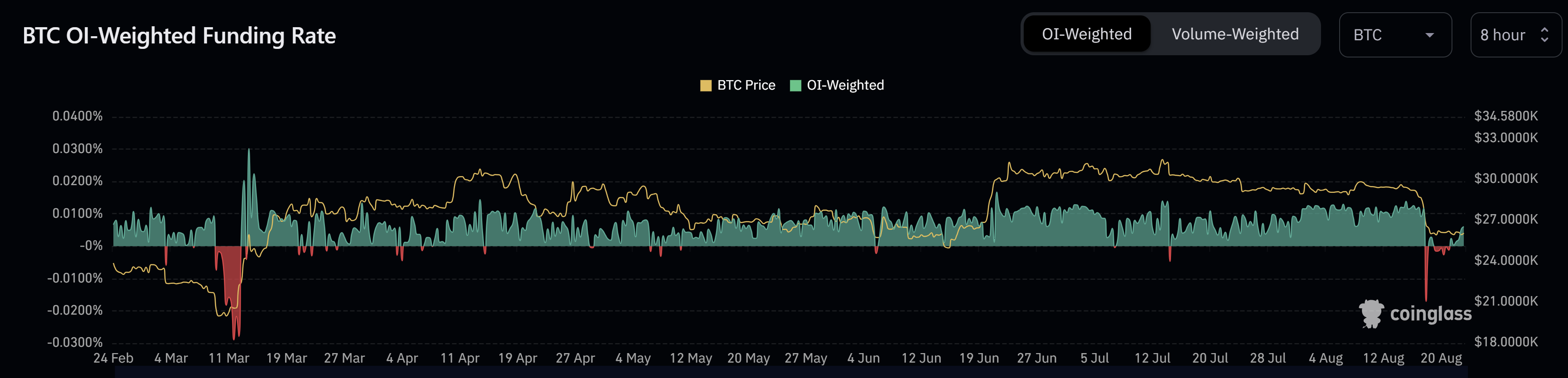

BTC’s OI-weighted funding charge has already turned constructive once more at +0.0060. If the worth turns damaging for a number of days, because it did earlier than the March 2023 rally, it might be an indication {that a} quick squeeze is on the playing cards. However, after Thursday’s crash, the metric remained in damaging territory just for a short while.

BTC Short-Term Holders and Velocity

On-chain specialist Axel Adler Jr. factors out that the short-term Bitcoin holders (STH) cohort has decreased their holdings by a big 400,000 BTC. This mass exodus has put appreciable promoting strain available on the market, rendering many STHs “underwater” and thereby much less more likely to have interaction in bullish habits.

Moreover, Adler emphasizes the BTC Velocity metric, stating, “At the beginning of this year, the BTC Velocity metric dropped to its minimum level.” This extraordinarily low velocity signifies not simply low volatility, but additionally an absence of market participant exercise – a regarding signal for any imminent bullish flip. Therefore, Adler concludes:

Taking into consideration these two components, in addition to the truth that the STH cohort has historically been the first participant creating volatility within the BTC market, restoration after this drop would require extra time than ordinary and should take an indefinite interval.

At press time, BTC traded at $26,114.

Featured picture from iStock, chart from TradingView.com