In context: Believe it or not, Netflix continues to be the king of streaming video leisure. It’s straightforward to assume that with competitors like Comcast and Disney, it might be floundering, particularly after shedding numerous licensed content material to its competitors. However, the previous Big Cable boys are failing on the streaming sport.

The Financial Times reviews that a number of the largest leisure firms will put up greater than $5 billion in losses from their streaming companies for 2023. Disney, Comcast, and Paramount streaming divisions will all find yourself within the pink for the year, and Warner Bros Discovery managed a small revenue. However, traders are already clamoring about downsizing and spinning off elements of the enterprise.

Paramount+ is arguably in essentially the most hassle. The streaming service began as CBS All Access, which re-merged with Viacom in 2019 and was carried solely by Xfinity Flex (Comcast) in January 2020. By September 2020, Viacom rebranded the platform to Paramount+ with plans to make it a standalone streaming service and develop programming from on-demand CBS exhibits to extra authentic sequence and “premium” content material.

Within the previous couple of weeks, controlling stakeholder Shari Redstone has initiated talks to promote the platform to Skydance. Talks are within the early levels, so particulars in regards to the deal are scarce. Paramount CEO Bob Bakish reportedly spoke with Warner CEO David Zaslav relating to a merger, as nicely. However, inside sources warned that each offers are tentative and may not materialize.

In addition to the losses in streaming, the previously “conventional” media conglomerates are fighting a stingy promoting market, a major dip in TV income, and a spike in manufacturing prices introduced on by the latest 148-day writers strike.

LightShed Partners analyst Rich Greenfield stated Paramount is in panic mode, desperately looking for a merger.

“TV promoting is falling far brief, cord-cutting is continuous to speed up, sports activities prices are going up, and the film enterprise is just not performing,” Greenfield stated. “Everything goes improper that may go improper. The solely factor [the companies] understand how to do to survive is attempt to merge and minimize prices.”

Let’s deal with the elephant within the room since Greenfield was so form to carry it up. Big Cable’s plans of taking over streaming are starting to backfire as cord-cutters say, “No! We won’t have it.” People migrated to companies like Netflix and Hulu to escape the perceived company greed of community TV and cable firms providing tons of of channels “of worth” of their fundamental packages whereas scattering the handful of high quality content material throughout more and more higher-priced premium bundles.

It hit Big Cable and Hollywood laborious within the pocketbook as folks flocked on-line. So, it thought to copycat established streaming companies and take again beforehand licensed content material so they might gather all of the income themselves. It seems now that these plans are falling aside, no less than partially, due to cord-cutters stubbornly not shopping for into each streaming platform on the planet, notably the newer ones backed by the company overlords that precipitated them to flee cable within the first place.

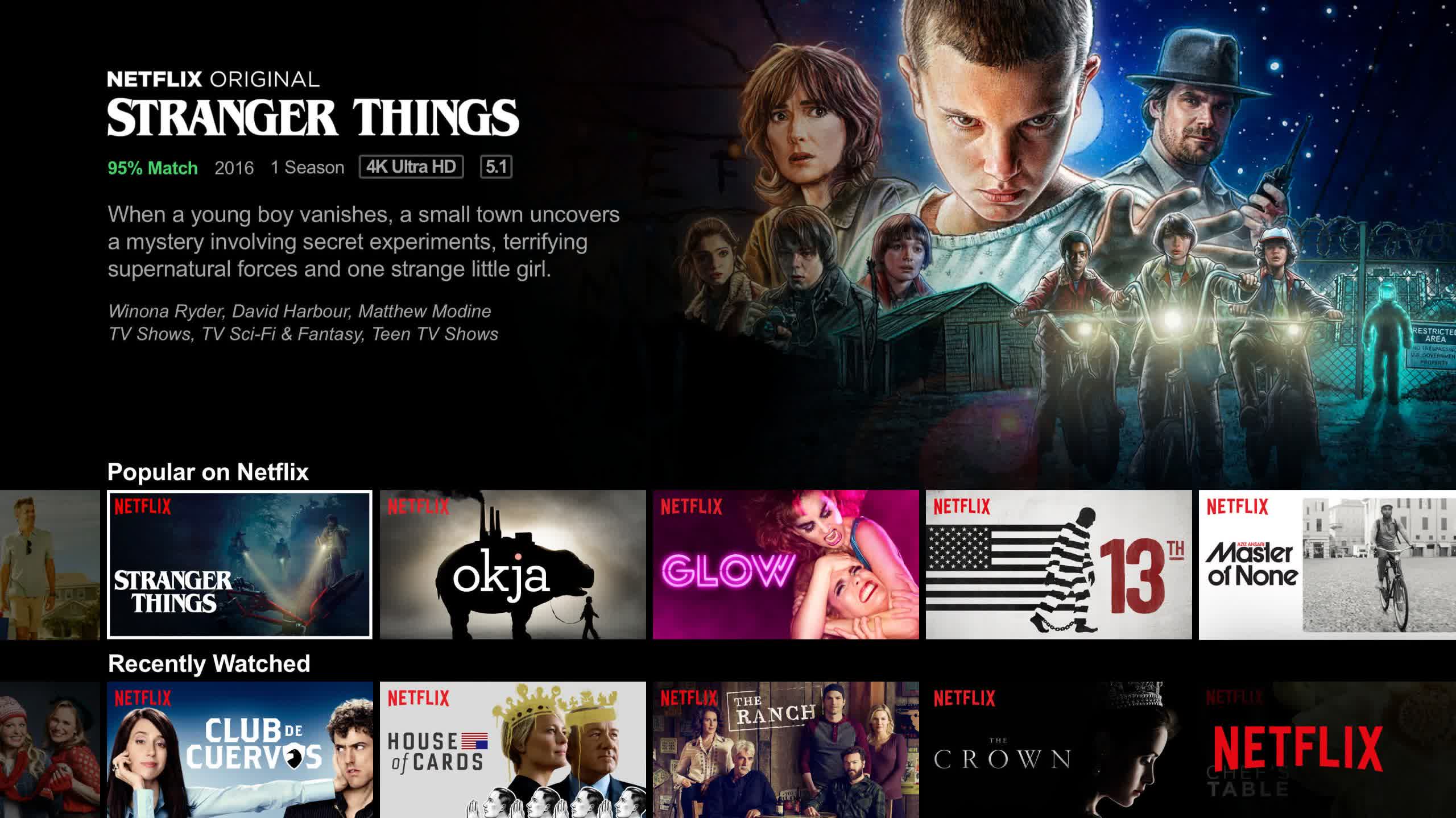

So the actual winner in all of this hustle is Netflix, which pioneered streaming VOD (video on demand) companies.

“For a lot of the previous 4 years, the leisure trade spent cash like drunken sailors to struggle the primary salvos of the streaming wars,” opined trade analyst Michael Nathanson in November. “Now, we’re lastly beginning to really feel the hangover and the load of the unpaid bar invoice. [For Netlix’s competitors], the shakeout has begun.”

Netflix has remained worthwhile for essentially the most half over the final a number of years. Its most up-to-date earnings report blew Wall Street analysts’ predictions out of the water, including over 9 million new subscribers. The progress was one of the best the corporate has seen since early 2020, when pandemic lockdowns compelled folks to “Netflix and chill.” Even latest “aggressive” worth hikes haven’t harmed the platform.

Meanwhile, smaller upstarts are shedding prospects to hikes as they battle to keep afloat. For these firms, it is merge or die. Warner was ready to eke out a small revenue for the year thanks to worth hikes, canceling some exhibits, and signing licensing offers with, guess who? Netflix.

Unfortunately, it additionally noticed over two million subscribers stroll out the door in simply the final two quarters. Many misplaced prospects have been inevitable. Still, Warner Discovery’s ill-advised determination to not renew its licensing take care of Sony and successfully “stealing” tons of of exhibits from hundreds of PlayStation house owners who had bought Discovery content material most likely did not assist regardless of having since reversed its determination.

Even the leisure behemoth Disney won’t escape 2023 unscathed. It misplaced a whopping $1.6 billion from its Disney+ streaming platform within the first three quarters of the year. These losses come regardless of gaining eight million new subscribers in the identical timeframe. It is now in the course of restructuring, which has price 7,000 staff their jobs. It now forecasts that the platform will turn into worthwhile in 2024.

According to Greenfield, progress by acquisition is just not the reply. Companies like Warner, taking pictures to flip losses round by merging with different firms within the streaming sector, could undergo much more.

“The proper reply needs to be, let’s cease making an attempt to be within the streaming enterprise,” he stated. “The reply is, let’s get smaller and targeted and cease making an attempt to be an enormous firm. Let’s dramatically shrink.”

Image credit score: Trusted Reviews