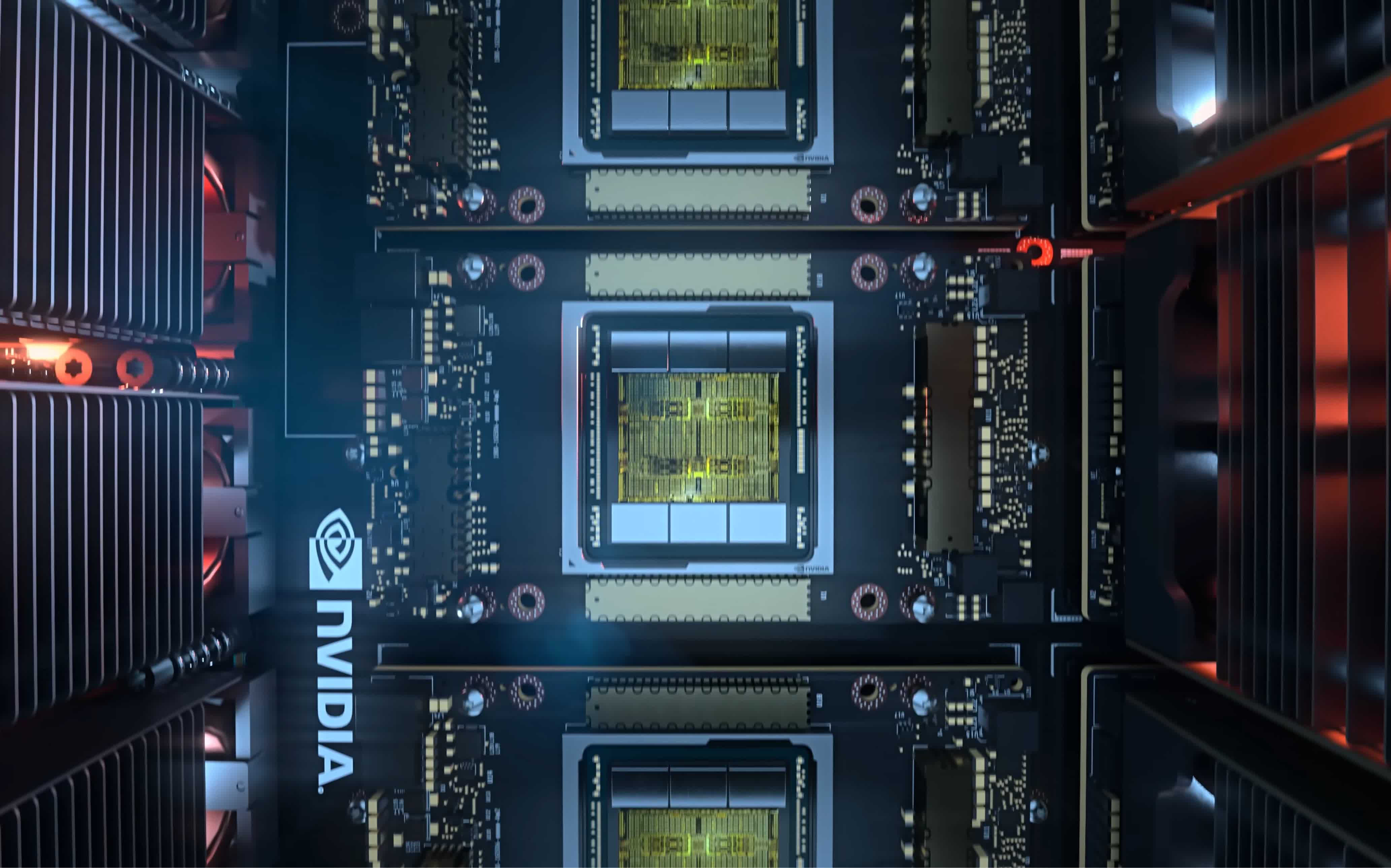

The huge image: Starting tomorrow, Nvidia is internet hosting its GTC developer convention. Once a sideshow for semis, the occasion has remodeled into the focus for a lot of the business. With Nvidia’s rise, many have been asking the extent to which Nvidia’s software supplies a sturdy aggressive moat for its {hardware}. As we’ve been getting a whole lot of questions on that, we wish to lay out our ideas right here.

Beyond the potential announcement of the next-gen B100 GPU, GTC is not likely an occasion about chips, GTC is a present for builders. This is Nvidia’s flagship occasion for constructing the software ecosystem round CUDA and the different items of it is software stack.

It is vital to notice that when speaking about Nvidia many individuals, ourselves included, have a tendency to make use of “CUDA” as shorthand for all the software that Nvidia supplies. This is deceptive as Nvidia’s software moat is greater than just the CUDA improvement layer, and this is going to be essential for Nvidia in defending its place.

Editor’s Note:

Guest creator Jonathan Goldberg is the founding father of D2D Advisory, a multi-functional consulting agency. Jonathan has developed development methods and alliances for corporations in the cell, networking, gaming, and software industries.

At final yr’s GTC, the firm put out 37 press releases, that includes a dizzying array of companions, software libraries and fashions. We anticipate extra of this subsequent week as Nvidia bulks up its defenses.

These companions are vital as a result of there at the moment are a whole lot of corporations and hundreds of thousands of builders constructing instruments on high of Nvidia’s choices. Once constructed, these persons are unlikely to rebuild their fashions and purposes to run on different firm’s chips, not less than any time quickly. It is price noting that Nvidia’s companions and prospects span dozens of business verticals, and whereas not all of these are going all-in on Nvidia, it nonetheless demonstrates immense momentum in Nvidia’s favor.

Put merely the defensibility of Nvidia’s place proper now rests on the inherent inertia of software ecosystems. Companies put money into software – writing the code, testing it, optimizing it, educating their workforce on its use, and so on. – and as soon as that funding is made they’re going to be deeply reluctant to change.

We noticed this with the Arm ecosystem’s try to maneuver into the knowledge middle over the final ten years. Even as Arm-based chips began to exhibit actual energy and efficiency benefits over x86, it nonetheless took years for the software corporations and their prospects to maneuver, a transition that is nonetheless underway. Nvidia seems to be in early days of build up precisely that type of software benefit. And if they will obtain it throughout a large swathe of enterprises, they’re prone to maintain onto for a few years. This greater than the rest is what positions Nvidia finest for the future.

Nvidia has formidable boundaries to entry in its software. CUDA is an enormous a part of that, however even when alternate options to CUDA emerge, the manner during which Nvidia is offering software and libraries to so many factors to them constructing a really defensible ecosystem.

We level all this out as a result of we’re beginning to see alternate options to CUDA emerge. AMD has made a whole lot of progress with its reply to CUDA, ROCm. However, once we say progress, we imply they now have a superb, workable platform, however it can take years for it to achieve even a share of the adoption of CUDA. ROCm is solely obtainable on a small variety of AMD merchandise right this moment, whereas CUDA has labored on all Nvidia GPUs for years.

Other alternate options like UXL or various combos of PyTorch and Triton, are equally fascinating but in addition in early days. UXL specifically seems promising, because it is backed by a bunch of a few of the greatest names in the business. Of course, that is additionally its biggest weak spot, as these members have extremely divergent pursuits.

We would argue that little of it will matter if Nvidia can get entrenched. And right here is the place we have to distinguish between CUDA and the Nvidia software ecosystem. The business will provide you with alternate options to CUDA, however that doesn’t imply they will fully erase Nvidia’s software boundaries to entry.

Also learn: Goodbye to Graphics: How GPUs Came to Dominate AI and Compute – No Longer “Just” a Graphics Card

That being stated, the greatest menace to Nvidia’s software moat is its largest prospects. The hyperscalers have little interest in being locked into Nvidia in any manner, and so they have the sources to construct alternate options. To be honest, they don’t seem to be proof against staying near Nvidia, it stays the default resolution and nonetheless has many benefits, but when anybody places a dent in Nvidia’s software ambitions, it is almost certainly to be from this nook.

And that, in fact, opens up the query as to what precisely Nvidia’s software ambitions are.

In previous years, as Nvidia launched its software choices, as much as and together with its cloud service Omniverse, they’ve conveyed a way that they’d ambitions to create a brand new part of their income stream. On their newest earnings name, they identified that they’d generated $1 billion in software income. However, extra lately, we’ve gotten the sense that they could be repositioning or scaling again these ambitions a bit, with software now positioned as a service they supply to their chip prospects somewhat than a full-blown income section in its personal proper.

After all, promoting software dangers placing Nvidia in direct competitors with all its greatest prospects.