Polygon (MATIC), a blockchain scalability platform, finds itself within the grip of destructive sentiment that casts a shadow over its prospects for a robust worth restoration. The crypto market has been a risky house, liable to sudden shifts in sentiment, and MATIC is not any exception.

The current downturn within the sentiment surrounding MATIC has left buyers and merchants cautiously observing the value charts.

Once thought of a promising mission within the crypto house, Polygon’s potential for development has been impeded by the current actions of the US Securities and Exchange Commission towards altcoins.

Will the destructive sentiment proceed to hinder MATIC’s potential for a robust worth restoration?

Polygon Whales Unfazed By US Regulatory Pressure?

The newest knowledge on MATIC reveals that the stress from US regulators has not appeared to completely unsettle some distinguished buyers, as evidenced by a notable improve in whale transactions exceeding $1 million in current days.

Source: Santiment

However, regardless of the rise in whale urge for food, the cryptocurrency has did not maintain a robust upward momentum on the time of writing.

Source: CoinMarketCap

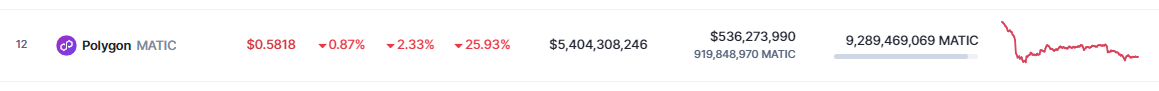

CoinMarketCap stories MATIC’s present worth as $0.5818, reflecting a decline of two.33% throughout the previous 24 hours. Additionally, the cryptocurrency has witnessed a considerable droop of 25.93% over the previous seven days.

In addition to the influence of regulatory stress, the actions of MATIC’s provide on exchanges, which serves as an indicator of short-term promoting stress, have exhibited speedy fluctuations throughout the identical interval.

MATIC 24-hour worth motion. Source: CoinMarketCap

It skilled a pointy improve, adopted by a decline, after which one other spike earlier than ultimately easing on the time of publication.

These developments point out that the promoting stress on MATIC stays a big concern, primarily because of the prevailing regulatory uncertainty.

MATIC market cap at the moment at $5.4 billion. Chart: TradingView.com

Fed’s Pause On Rate Hikes Fails To Stabilize Crypto Markets

On the entire, monetary markets have continued to exhibit risky actions, inflicting cryptocurrencies to decouple from the efficiency of conventional equities markets.

The current downturn within the crypto market appears to be linked to the press convention held by Federal Reserve Chairman Jerome Powell on June 14, throughout which he introduced that the central financial institution would quickly halt charge hikes for the month of June.

While this resolution aligned with buyers’ expectations, it had an surprising impact on the crypto market. Instead of stabilizing, the market skilled a reversal in its course and resumed the continued sell-off that has continued for the previous three weeks.

The presence of considerable macroeconomic challenges, coupled with the anticipation of future charge hikes and low buying and selling quantity, means that the volatility within the cryptocurrency market is more likely to persist within the foreseeable future.

The prevailing headwinds, together with financial components on a bigger scale, have contributed to the unpredictability and turbulence within the crypto market.

Featured picture from Analytics Insight