Aurich Lawson | Getty Images

Yesterday, Microsoft introduced that it made 31 p.c much less off Xbox {hardware} in the primary quarter of 2024 (ending in March) than it had the yr earlier than, a lower it says was “pushed by decrease quantity of consoles offered.” And that is not as a result of the console offered notably nicely a yr in the past, both; Xbox {hardware} income for the primary calendar quarter of 2023 was already down 30 p.c from the earlier yr.

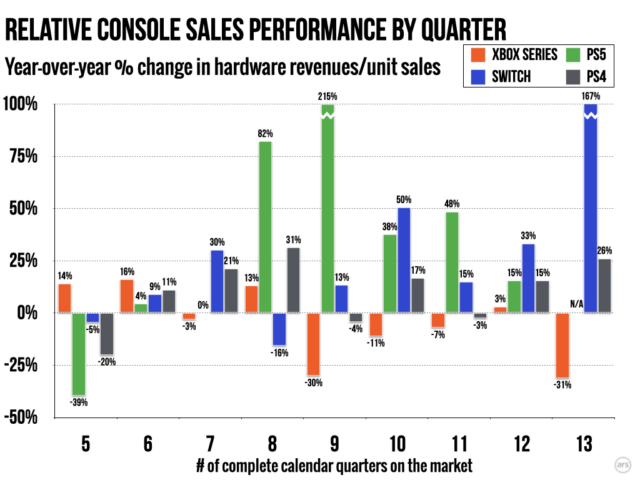

Those two knowledge factors communicate to a console that’s struggling to considerably improve its participant base throughout a interval that ought to, traditionally, be its strongest sales interval. But getting wider context on these numbers is a bit troublesome due to how Microsoft experiences its Xbox sales numbers (i.e., solely in phrases of quarterly adjustments in whole console {hardware} income). Comparing these annual shifts to the unit sales numbers that Nintendo and Sony report each quarter just isn’t precisely easy.

Context clues

Kyle Orland

To try some direct contextual comparability, we took unit sales numbers for some latest profitable Sony and Nintendo consoles and transformed them to Microsoft-style year-over-year share adjustments (aligned with the launch date for every console). For this evaluation, we omitted every console’s launch quarter, which comprises lower than three months of whole sales (and sometimes contains plenty of pent-up early adopter demand). We additionally skipped the primary 4 quarters of a console’s life cycle, which haven’t got a year-over-year comparability level from 12 months prior.

This nonetheless is not an ideal comparability. Unit sales do not map on to whole {hardware} income because of issues like inflation, the rest sales of Xbox One {hardware}, and value cuts/reductions (although the Xbox Series S/X, PS5, and Switch nonetheless have but to see official value drops). It additionally would not take note of the baseline sales ranges from every console’s first yr of sales, making whole lifetime sales efficiency on the Xbox aspect exhausting to gauge (although latest knowledge from a Take-Two funding name suggests the Xbox Series S/X has been closely outsold by the PS5, at this level).

Even with all these caveats, the comparative knowledge developments are fairly clear. At the beginning of their fourth full yr available on the market, latest profitable consoles have been having fun with a basic upswing in their year-over-year sales. Microsoft stands out as a serious outlier, making much less income from Xbox {hardware} in 4 of the final 5 quarters on a year-over-year foundation.

Aurich Lawson

Those numbers counsel that the {hardware} sales price for the Xbox Series S/X could have already peaked in the final yr or two. That could be traditionally early for a console of this sort; earlier Ars analyses have proven PlayStation consoles usually see their sales peaks in their fourth or fifth yr of life, and Nintendo portables have proven the same sales development, traditionally. The Xbox Series S/X development, alternatively, seems extra just like that of the Wii U, which was already deep in a “loss of life spiral” at the same level in its business life.

This just isn’t the tip

In the previous, console sales developments like these would have been the signal of a {hardware} maker’s wider struggles to remain afloat in the gaming enterprise. However, in at this time’s gaming market, Microsoft is in a spot the place console sales will not be strictly required for general success.

For occasion, Microsoft’s whole gaming income for the most recent reported quarter was up 51 p.c, thanks in giant half to the “internet affect from the Activision Blizzard acquisition.” Even earlier than that (very costly) merger was accomplished, Microsoft’s whole gaming income was usually partially buoyed by “progress in Game Pass” and powerful “software program content material” sales throughout PC and different platforms.

Activision

Perhaps it is no shock that Microsoft has proven growing willingness to take some former Xbox console exclusives to different platforms in latest months. In reality, following the Activision/Blizzard merger, Microsoft is now publishing extra top-sellers on the PS5 than Sony. And let’s not neglect the PC market, the place Microsoft continues to promote thousands and thousands of video games above and past its PC Game Pass subscription enterprise.

So, whereas the business way forward for Xbox {hardware} could look a bit unsure, the way forward for Microsoft’s general gaming enterprise is in a lot much less dire straits. That could be true even when Microsoft’s Xbox {hardware} income fell by 100%.