EduFi, a fintech startup that allows financially strapped college students to safe loans for their training, has raised $6.1 million in a pre-seed spherical led by Zayn VC with participation from Palm Drive Capital, Deem Ventures, Q Business and angel traders.

The Singapore-based startup has launched a man-made intelligence-powered examine now, pay later (SNPL) lending platform and its cellular app in Pakistan, a rustic that doesn’t have student loan merchandise as a class; as an alternative, customers take private loans with excessive curiosity and prolonged course of, Aleena Nadeem, founder and CEO of EduFi, instructed Ztoog.

EduFi desires to handle the nation’s two points — excessive poverty ranges and low literacy charges — by way of its fintech platform. In Pakistan, about 40% of scholars attend non-public faculties resulting from public faculties’ poor high quality, leading to spending greater than $14 billion on their training yearly. Moreover, over 50% of the grownup inhabitants in Pakistan doesn’t have entry to monetary companies corresponding to financial institution accounts and insurance coverage.

Nadeem, an MIT graduate who beforehand labored at Goldman Sachs and Ventura Capital, had seen first-hand many kids wrestle with monetary obstacles to get a high quality training whereas working at Progressive Education Network (PEN) in Pakistan. PEN is a nonprofit group that offers free and high quality training to kids who can’t afford it.

“Many children in Pakistan make it to high school, but there is a sharp drop in those who are able to achieve a higher college education,” Nadeem stated. “This drop is where EduFi is trying to inject capital into the gap between high school graduation and first-year university admission.”

The two-year-old firm has already had partnerships with 15 universities, permitting the app to be accessible to about 200,000 college students who should pay their charges for undergrad, Master’s and PhD throughout Pakistan.

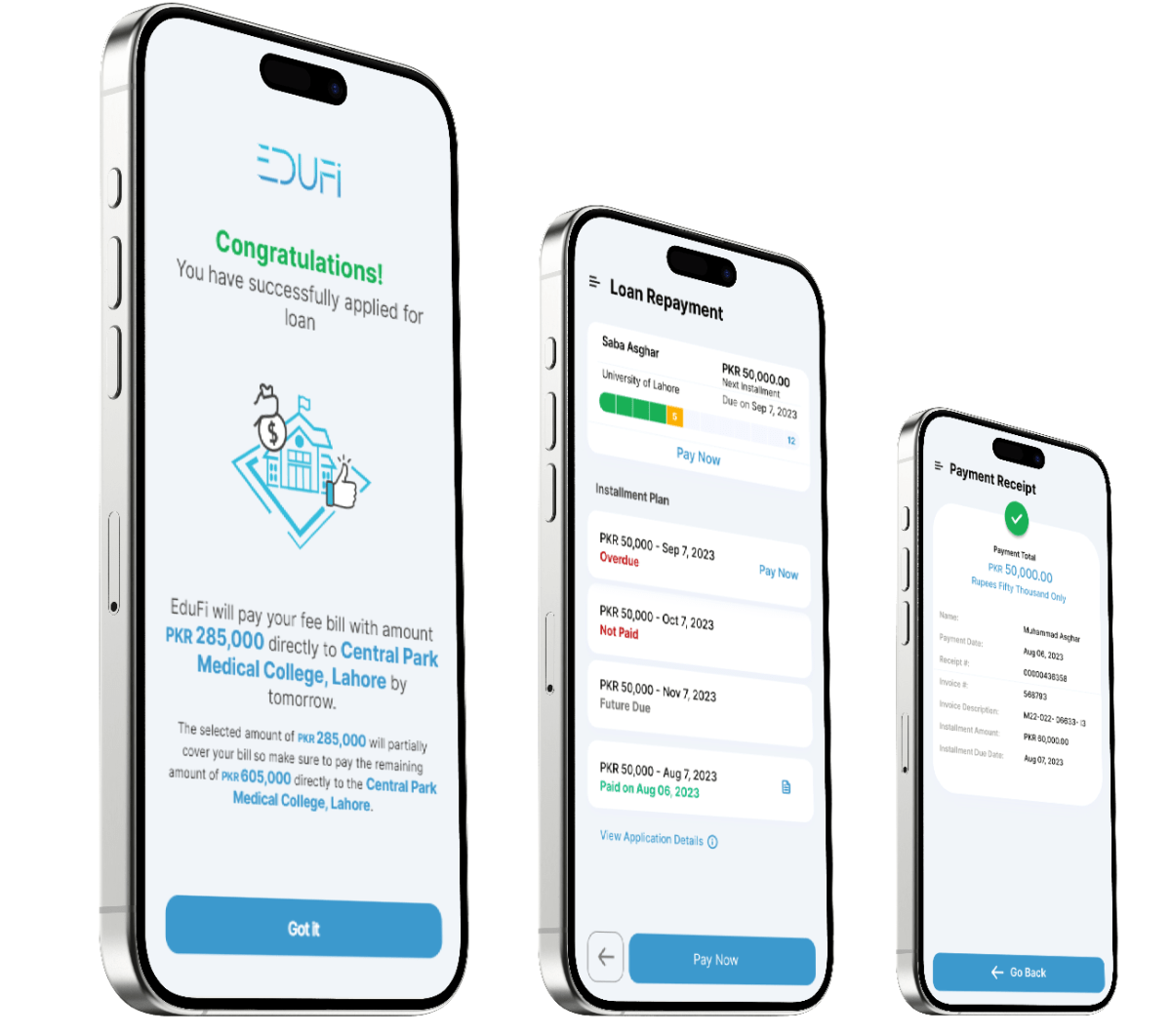

When a student (or a mum or dad) applies for loans by way of the app, EduFi requires the applicant’s (student or mum or dad) monetary standing. For instance, the earlier 12 months’ financial institution statements or a supply of earnings that may help their loan repayments, corresponding to a salaried job, a small enterprise, or freelance work. Once a student loan facility is accredited, EduFi sends the cash on to the school’s financial institution.

During its beta part for the final 18 months, EduFi examined its credit score mannequin towards 80,000 shopper finance loans banks had made. The startup claims that its credit score scoring system permits for the dispersal of student loans inside 48 hours of software and the short disbursal of the loan. EduFi, which has obtained approval for a license to make loans from the Securities and Exchange Commission Pakistan (SECP), is ready for the license to be granted, which is anticipated in November. Nadeem stated it’s at the moment validating its product and repair with potential clients and accumulating suggestions and knowledge to enhance its service.

The firm says it upended the normal financial institution strategy, which includes high-interest charges and a sophisticated software course of, in addition to takes not less than three to 4 weeks to approve. EduFi’s digital lending app affords customers a handy, simple course of and versatile loan phrases and circumstances.

“Education offers hope and can change the lives of people. I am one example of millions out there. EduFi offers this hope and will be a trigger for change in the lives of people as we lift one of the biggest burdens on aspiring families,” Nadeem stated. “For example, students in dental or medical schools have to pay upwards of $8,000 upfront, which is not sustainable for many in Pakistan. Every student we’ve helped is a testament to the ambition, opportunity and empowerment we are striving for at EduFi.”

The firm will use the pre-seed capital to succeed in extra clients, optimize its platform, broaden to neighboring nations and launch different fintech merchandise, together with student bank cards.

“This is a significant step towards achieving financial inclusion for middle and low-income families. In Pakistan, families spend more than 50% of their income on their children’s education, which has become increasingly challenging due to inflationary pressures. EduFi’s innovative approach will help alleviate this burden and empower families to invest in their children’s future,” Faisal Aftab, basic accomplice and founder at Zayn VC, stated in an announcement.