Consumers within the U.S. have the reminiscence of a goldfish.

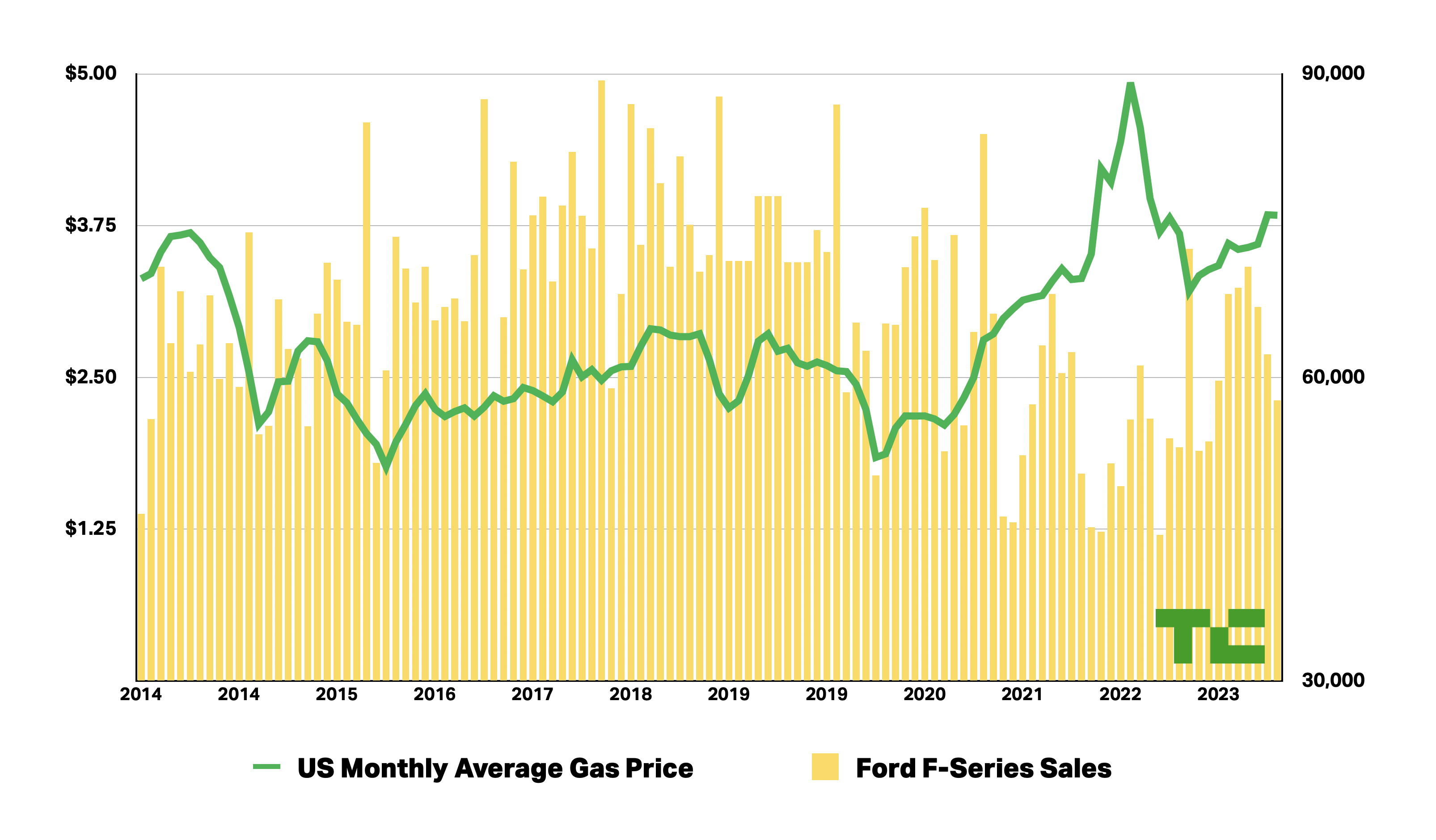

When gasoline costs are up, they search out extra fuel-efficient transportation. But once they’re down, they rush to purchase the largest truck potential. Just check out Ford F-Series gross sales knowledge from the final decade juxtaposed with common month-to-month gasoline costs.

Image Credits: Tim De Chant/Ztoog+

See? Goldfish.

It seems U.S. automakers resemble their buyer base. Just a few years in the past, they have been bullish on electrical autos. But now, after only a couple years of great funding, they’re beginning to get chilly toes.

Ford and GM, particularly, have stated that they’re simply responding to their prospects’ wants. And possibly they’re! Some customers stay cautious as a result of EV charging nonetheless sucks. Others have been scared off by excessive costs. (Arguably, these are each self-inflicted wounds: Legacy automakers have refused to think about charging a key a part of the possession expertise, and Ford and GM have regularly hiked EV costs in a method that’s out of step with the market.)

Such buyer responsiveness might be an asset in regular occasions, permitting firms to modify their product traces to trip the ups and downs of the market. Yet in occasions of transition, when the long run is in flux, it may be a horrible method to run a enterprise.

Legacy automakers have lengthy stated that their worthwhile mannequin traces can be a power because the market transitions to electrical autos. All three firms have introduced that they’d be investing billions in growing EVs and making the batteries that energy them, and it could seem that the plan is figuring out simply high-quality.

Over the final decade, automakers have flocked to crossovers, SUVs and pickup vehicles, three segments which can be probably the most worthwhile. U.S. automakers have gone additional than most. Ford even went so far as to cease producing mass market automobiles, focusing as a substitute on crossovers, SUVs and pickups with the occasional Mustang coupe thrown in for branding functions.

How’s it been figuring out? Pretty nicely, truly. Ford reported $1.2 billion in revenue for Q3, not unhealthy given headwinds induced by the UAW strike. GM did higher, raking in $3.1 billion in the identical quarter. Stellantis doesn’t typically announce its quarterly earnings till November, however it had a gangbuster first half of the 12 months, posting $12.1 billion in revenue.

So why have Ford and GM determined to pump the brakes on their EV plans?