Less than per week after Vitalik Buterin, one of many co-founders of Ethereum, bought his Maker (MKR) stash for ETH, one crypto whale has executed the other. On-chain knowledge on September 4 shows that one Ethereum holder bought 694 ETH, value roughly $1.13 million when writing, for 1,010 MKR. At the time of the swap, MKR was altering arms at $1,122.

Whale Swaps ETH For MKR

As of September 4, the tackle, “0x3737,” had over $20.37 million value of belongings. While the whale trades towards Vitalik and doubles down on MKR, zooming in on the tackle’s portfolio exhibits that the most important holding is ETH.

The tackle holds 10,000 ETH value $16.3 million at spot charges, representing over 75% of the full portfolio. Meanwhile, a few of his different main holdings embrace Arbitrum (ARB), value $2.9 million, and MKR, value $1.1 million.

MKR, the token issued by MakerDAO, the decentralized autonomous group (DAO) that controls the minting of DAI, a stablecoin on Ethereum, has been ripping larger in the previous few months.

MKR performs a key function in stabilizing DAO and is used as a final resort. Holders take part in governance, voting on proposals that greatest stabilize the algorithmic stablecoin, deciding collateral sorts accepted, stability charge changes, and others.

From June, MKR has greater than doubled, rising 125% to peak at round $1,300 in early August. It is now buying and selling at over $1,100, up 13% from August lows.

Maker Presents Endgame

The token’s surge has been attributed to a number of components, particularly the discharge of the “Endgame” roadmap. Under this plan, MakerDAO plans to, amongst different issues, launch their blockchain, rebrand, and introduce two extra tokens.

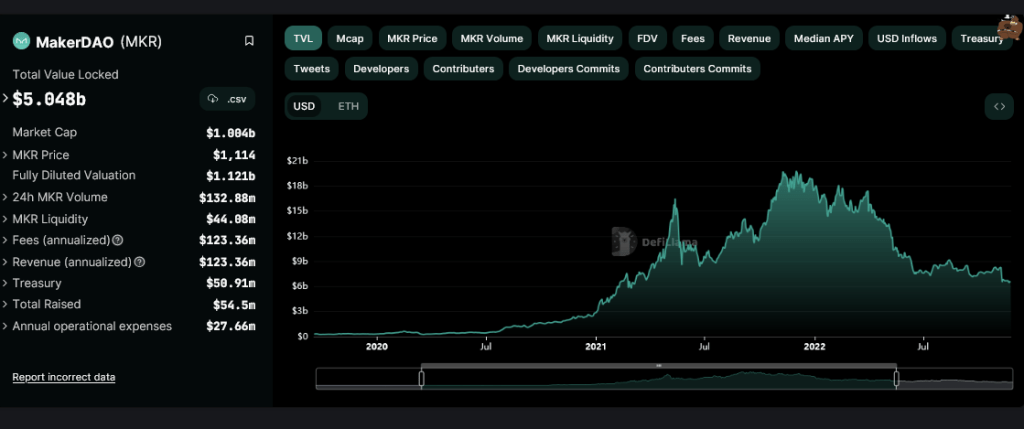

This transfer is important as a result of MakerDAO is among the many first decentralized finance (DeFi) protocols. According to DeFiLlama knowledge, the protocol has a complete worth locked (TVL) of over $5 billion. It is the most important decentralized cash market on the planet.

Meanwhile, DAI, its algorithmic yield-earning stablecoin, has been steady just lately and is the most important in Ethereum. At press time, DAI had a market cap of $5.3 billion, perched at twelfth on the leaderboard. At this tempo, DAI is the third-largest stablecoin after USDT and USDC.

Vitalik Buterin, regardless of the stellar efficiency of MKR relative to the broader crypto market, liquidated $580,000 value of MKR after MakerDAO’s co-founder, Rune Christensen, mentioned it was contemplating launching a brand new blockchain bridging to Ethereum that’s based on Solana’s code. The new blockchain, dubbed NewChain, is a part of MakerDAO’s roadmap, “Endgame”.

Feature picture from Canva, chart from TradingView