Clint and Rachel Wells had causes to think about buying an electrical car when it got here to changing certainly one of their automobiles. But they’d even more causes to stay with petrol.

The couple dwell in Normal, Illinois, which has loved an financial increase from the electrical car meeting plant opened there by upstart electric-car maker Rivian. EVs are a step ahead from “using dead dinosaurs” to energy automobiles, Clint Wells says, and he desires to assist that.

But the couple determined to “get what was affordable”—of their case, a petrol-engined Honda Accord costing $19,000 after trade-in.

An EV priced at $25,000 would have been tempting, however solely 5 new electrical fashions costing lower than $40,000 have come on to the US market in 2024. The hometown champion’s deal with luxurious automobiles—its most cost-effective mannequin is at present the $69,000 R1T—made it a non-starter.

“It’s just not accessible to us at this point in our life,” Rachel Wells says.

The Wells are among the many thousands and thousands of Americans opting to proceed buying combustion-engine automobiles over electrical automobiles, regardless of President Joe Biden’s bold goal of getting EVs make up half of all new automobiles bought within the US by 2030. Last 12 months, the proportion was 9.5 %.

High sticker costs for automobiles on the forecourt, and excessive rates of interest which can be pushing up month-to-month lease funds, have mixed with issues over driving vary and charging infrastructure to sit back patrons’ enthusiasm—even amongst those that think about themselves inexperienced.

Financial Times

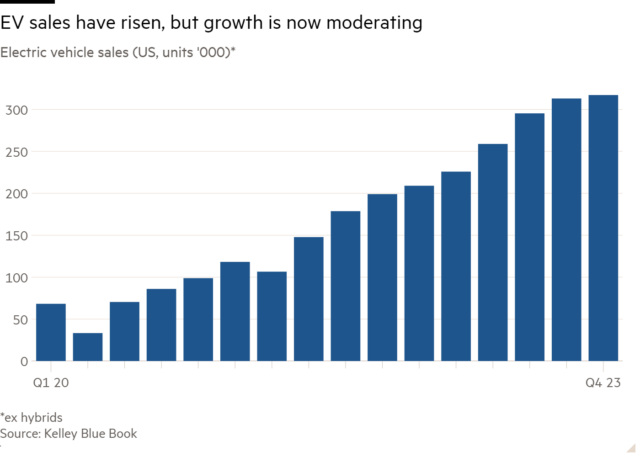

While EV expertise continues to be enhancing and the recognition of electrical automobiles continues to be growing, gross sales progress has slowed. Many carmakers are rethinking manufacturing plans, slicing the numbers of EVs they’d deliberate to supply for the US market in favor of combustion-engined and hybrid automobiles.

Electric automobiles have additionally discovered themselves on the intersection of two competing Biden administration priorities: tackling local weather change and defending American jobs.

Biden has pledged to decrease US greenhouse fuel emissions to 50-52 % under 2005 ranges by 2030, with widespread EV adoption a major a part of that ambition.

But he desires to realize it with out recourse to imports from China, the world’s greatest producer of EVs and a dominant participant in most of the uncooked supplies that go into them. Washington has set out an industrial coverage that hits Chinese producers of automobiles, batteries and different elements with punitive tariffs and restricts federal tax incentives for customers buying their merchandise.

The concept is to permit the US to develop its personal provide chains, however analysts say such protectionism will lead to greater EV costs for US customers within the meantime. That might stall gross sales and outcome within the US remaining behind China and Europe in adoption of EVs, placing in danger not solely the Biden administration’s targets but additionally the worldwide uptake of EVs. The World Resources Institute says between 75 and 95 % of latest passenger automobiles bought by 2030 must be electrical if Paris settlement objectives are to be met.

Brian Cassella/Chicago Tribune/Getty Images

“There is no question that this slows down EV adoption in the US,” says Everett Eissenstat, a former senior US Trade Representative official who served each Republican and Democratic administrations.

“We are just not producing the EVs the consumers want at a price point they want.”

Incenting customers

The administration is trying to reconcile its industrial and local weather insurance policies by providing tax incentives to customers to purchase EVs and by encouraging producers to develop US-dominated provide chains.

Tax credit of as much as $7,500 can be found to patrons of electrical automobiles. But the complete quantity is just accessible on automobiles which can be made within the US with crucial minerals and battery elements additionally largely sourced within the US.

That means few automobiles qualify for the utmost credit score. Two years on from the passage of the Inflation Reduction Act, which set out Biden’s bold inexperienced transition technique, there are solely 12 fashions that may really rating patrons the complete $7,500.

The act additionally provided lots of of billions of {dollars} in subsidies and different incentives to firms constructing a home clear power trade. The automotive sector has been one of many beneficiaries of that largesse.

Last month, the Biden administration went a step additional, including steep new tariffs on billions of {dollars} of products imported from China. These included a quadrupling of the tariffs on imported electrical automobiles, a tripling of the speed on Chinese lithium-ion batteries to 25 % and the introduction of a 25 % tariff on graphite, which is used to make batteries.

The levies had been an extension of a package deal first imposed by then president Donald Trump as a part of his commerce battle with Beijing in 2018, and have been beneath overview by the Biden administration because it figures out how to reply to what it says are Beijing’s unfair subsidies to strategic industries.

Mandel Ngan/AFP/Getty Images

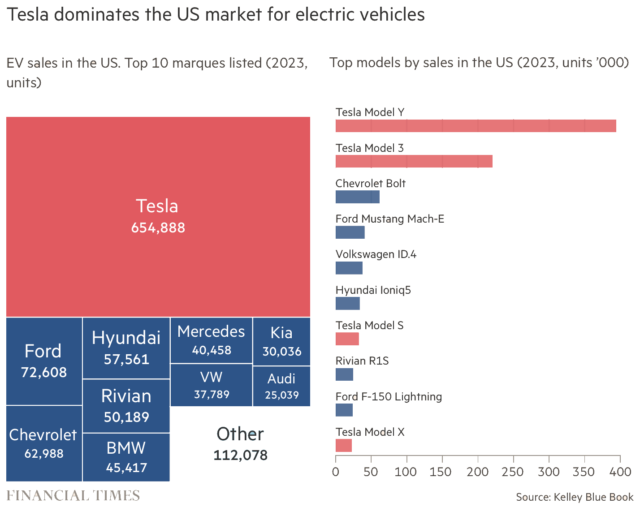

Few Chinese EVs can be found on the market within the US. Polestar is the one Chinese-owned carmaker at present lively within the nation and it bought a mere 2,210 automobiles within the first quarter—out of practically 269,000 new EV gross sales. (The firm plans so as to add manufacturing within the US this 12 months.)

Wendy Cutler, a former commerce official and vice-president of the Asia Society Policy Institute, describes the pre-emptive levying of tariffs as a brand new growth in world commerce coverage.

“This sends a clear signal to China: don’t even think about exporting your cars to the United States,” she says.

More important than the tariffs on Chinese electrical automobiles are the levies on lithium-ion batteries and the supplies and elements used to make them.

China is a key participant within the provide chain for EV batteries, with firms equivalent to BYD and CATL growing the nation’s capability over more than a decade. It dominates the processing of the minerals contained in lithium-ion batteries in addition to the manufacture of battery elements equivalent to cathodes and anodes.

According to knowledge analyzed by the Center for Strategic and International Studies (CSIS), a Washington think-tank, US-based carmakers have been importing a rising share of their batteries from China. In the primary quarter of 2024, more than 70 % of imported automotive batteries got here from the nation.

The tariffs will drive up manufacturing prices for carmakers within the US and that value is prone to be handed on to customers as a result of battery supplies and elements aren’t at present accessible in massive portions from any provide chain that excludes China.

US commerce officers draw parallels with the photo voltaic trade. The value of photovoltaic panels fell worldwide as Chinese producers, benefiting from subsidies, decrease labor prices and rising scale, got here to dominate the trade.

That has been a boon for customers, however resulted in manufacturing and jobs shifting from the US to China. Washington doesn’t need a rerun of this course of within the automotive sector.

“The idea that we should just open our gates and have a bunch of systematic Chinese economic abuses . . . and that that’s the answer to climate change is incredibly naive and short-sighted,” says Jennifer Harris, a former financial adviser to Biden.

In an election 12 months, the difficulty is politically charged too. Michigan and Ohio, each house to massive numbers of auto staff, are swing states within the presidential election. Both Biden and Republican nominee Donald Trump try to enchantment to working-class voters there.

Preserving jobs within the US auto trade because it strikes in the direction of inexperienced expertise is basically concerning the provide chain. More than half the 995,000 folks employed within the auto trade throughout the US are making components, quite than assembling automobiles, in line with the Bureau of Labor Statistics.

EVs already threaten these jobs as a result of their powertrains comprise fewer elements than automobiles with conventional engines and transmission techniques. The United Auto Workers union, arguing for a “just transition” to scrub power, fought throughout its six-week lengthy strike final autumn to have battery vegetation within the US lined by the identical contracts that shield staff at vegetation making petrol-powered automobiles, successful an settlement with General Motors.

Financial Times

Ilaria Mazzocco, chair in Chinese enterprise and economics at CSIS, says the lowered competitors and rising value of imported battery elements might delay worth decreases for US customers.

“It’s not just that the same car costs less in China, it’s that in China you have a wider variety,” says Mazzocco. “US automakers will have the leisure of not having competition, and they’ll be able to focus on making these high-cost trucks”—a reference to bigger sedans and SUVs, which have larger revenue margins.

“That’s just what the Biden administration feels they need to do on the political front, because they need to prioritize jobs,” she provides.

Price and infrastructure

Electric automobiles face different boundaries to mass adoption. Affordability, lack of charging infrastructure and vary anxiousness all stay issues for mainstream US automotive patrons.

The worth for a brand new EV averaged simply lower than $57,000 in May, in contrast with a mean of a bit of more than $48,000 for a automotive or truck with a conventional engine.

The beginning worth for a Tesla Model Y, by far the most well-liked electrical car within the US, was simply lower than $43,000 throughout the first quarter. The Ford F-150 Lightning, the electrified model of the best-selling pick-up truck within the US, was teased at $42,000 when it went on sale in May 2022 however now begins at $55,000—more than $11,000 above the petrol-powered F-150.

Used EVs are cheaper, with a car lower than 5 years previous costing about $34,000, in line with Cox Automotive. But they continue to be more costly than used automobiles with conventional engines, which common about $32,100—they usually make up simply 2 to three % of used car gross sales.

Brandon Bell/Getty Images

Ford and Stellantis, which owns manufacturers equivalent to Dodge, Ram and Jeep, are promising $25,000 EVs for the US market within the subsequent few years. General Motors plans to revive the Chevrolet Bolt as “the most affordable” EV in the marketplace. Tesla chief Elon Musk additionally informed buyers in April that Tesla would launch “more affordable models” this 12 months or early in 2025.

But these fashions will nonetheless face obstacles like a dearth of charging infrastructure. Overnight charging at house is the popular methodology of replenishing an EV, however that is solely actually an choice for many who can set up a charger on their property. Those residing in house complexes in states like California, the place a better share of individuals drive EVs, are more reliant on public charging services.

While there are about 120,000 petrol stations nationwide, in line with the US Department of Energy, there are solely 64,000 public charging stations within the US—and solely 10,000 of them are direct present chargers, which might replenish a battery in half-hour quite than a number of hours. Charging stations additionally will be inoperative or have lengthy traces when drivers arrive, forcing them to go elsewhere.

Potential patrons additionally fear their EV could not journey as far on a single cost as they require. While electrical automobiles are properly suited to the brief journeys that make up most driving, many Americans additionally use their automobiles and vehicles for longer distances and fear that charging en route could add to their driving time, and even depart them stranded. Cold climate and towing a load can each diminish an EV’s vary.

“What we’re seeing is the pace of EV growth is faster than the rate of publicly available charger growth,” says John Bozzella, chief govt of US auto commerce group the Alliance for Automotive Innovation.

Two methods

Many world carmakers are making large investments in US manufacturing vegetation, in response to the federal government’s incentives. But within the gentle of slowing EV gross sales progress they’re shifting that funding in the direction of hybrid automobiles, which use battery energy alongside a conventional engine.

Last month, executives from GM, Nissan, Hyundai, Volkswagen and Ford all mentioned that tapping into demand for hybrids was a precedence. Ford chief govt Jim Farley informed buyers at a convention “we should stop talking about [hybrids] as a transitional technology,” viewing it as a substitute as a viable long-term choice.

Hyundai mentioned it was contemplating making hybrids at its new $7.6 billion plant in Georgia. US competitor GM mentioned in January that it will reintroduce plug-in hybrid expertise to its vary, although chief govt Mary Barra lately affirmed she nonetheless noticed EVs as the long run.

Bozzella says that even with the tariff safety measures and US subsidies in place, he was uncertain how lengthy it will take for the US auto trade to supply EVs that would compete with closely backed Chinese automobiles on pricing.

“There is no question that EVs built in the US now, and built by American companies now, are absolutely competitive with EVs around the world,” he says, citing Tesla.

“If what you mean is competitive at price points . . . well that’s a different matter entirely, and my answer to that is: I’m not sure.”

Van Jackson, beforehand an official within the Obama administration and now a senior lecturer in worldwide relations at Victoria University of Wellington in New Zealand, says electrical automobiles nonetheless must fall in worth if the market is to develop considerably.

“How do you bring workers along and increase their wages, and have a growth market for these products, given how expensive they are?” he asks. “I’m an upper-middle-class person and I cannot afford an EV.”

He is skeptical about whether or not shutting the world’s dominant producer of EVs and associated componentry out of the US market will cut back the value of the automobiles and encourage uptake.

“The tariffs are buying time,” he says. “But towards no particular end.”

© 2024 The Financial Times Ltd. All rights reserved. Not to be redistributed, copied, or modified in any manner.