The Bitcoin value skilled a resurgence yesterday, reaching a excessive of $26,843, a 3.7% enhance after its current crash from $29,000. The causes behind this uptick are manifold.

Why Is Bitcoin Up?

According to on-chain analytics agency Santiment, important Bitcoin holders, sometimes called whales and sharks, have been actively including to their holdings. As of now, there are 156,660 wallets holding between 10 to 10,000 BTC, with a collective accumulation of $308.6M since August seventeenth. Whale and shark wallets have added 11,629 BTC prior to now six days.

Michaël van de Poppe, a well-regarded crypto analyst, drew consideration to the power proven by Silver & Gold, particularly after the disappointing PMI charges yesterday. He believes that as yields seem like topping out, Bitcoin may comply with the trajectory of those commodities.

Recent financial indicators from the US non-public sector present additional context. The S&P Global Composite PMI for early August confirmed a decline, falling to 50.4 from 52 in July. Both the Manufacturing and Services PMI indices additionally registered drops from 49 to 47 and 52.4 to 51 respectively.

Moreover, the Bitcoin futures market definitely performed a sure function in yesterday’s Bitcoin value motion. Yesterday, $28.06 million in brief positions had been liquidated on this market. After all, that is the third largest quantity in August thus far, surpassed solely by August 17 ($120 million) and August 8 ($37 million).

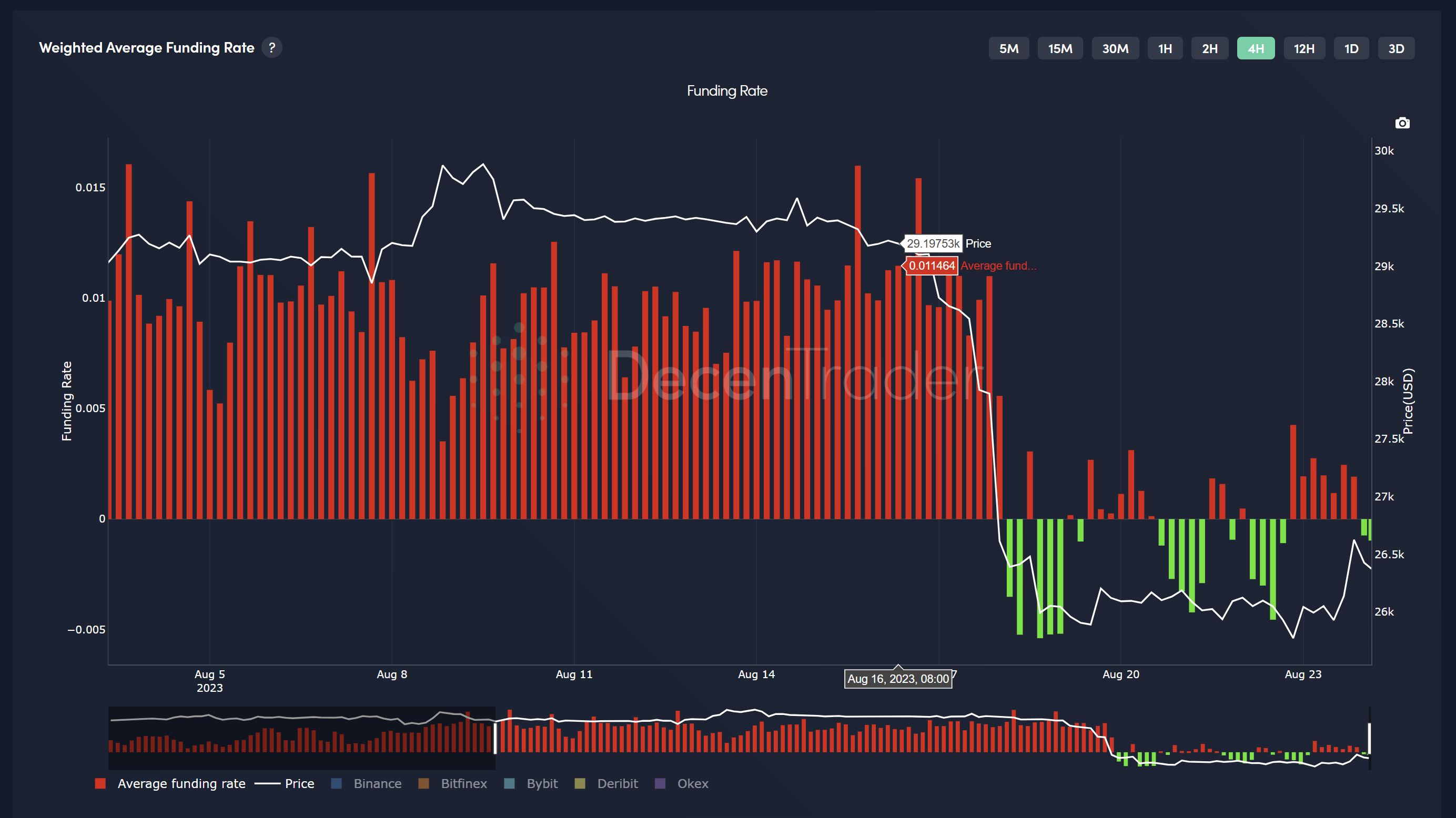

Market intelligence platform Decentrader highlighted the prevailing market sentiment, noting that regardless of Bitcoin’s value rise, there’s nonetheless a way of uncertainty and worry. This sentiment is additional underscored by the persevering with detrimental dip in common funding charges. While which means that sentiment continues to be unhealthy, it opens up the likelihood for extra quick squeezes if merchants are raging into shorts.

The Dollar-Index (DXY) and its inverse relationship with Bitcoin additionally performed an element. DXY was rejected slightly below 104 yesterday and dropped again to 103.5. The SPX confirmed a pleasant reduction bounce with USD coming off 103.96.

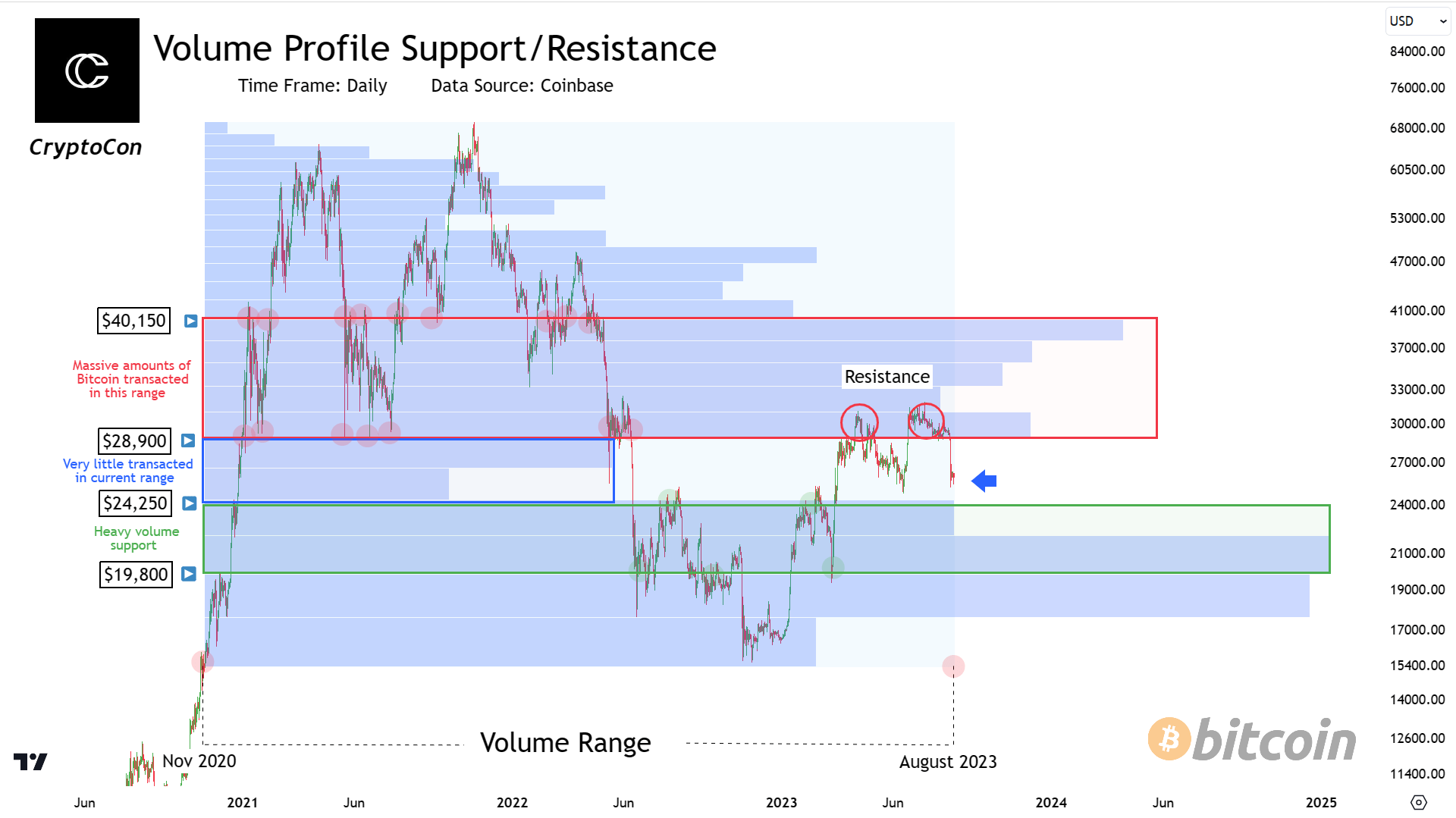

CryptoCon’s quantity evaluation gives a broader perspective on Bitcoin’s value motion. Since November 2020, the quantity of Bitcoin transacted reveals why the worth halted at its present place. The quantity previous $28,900 acts as a major barrier. However, the present vary of 24,000 to 29,000 for Bitcoin is comparatively uncharted, suggesting that Bitcoin is trying to find new help and making ready for a possible transfer to the following resistance zone.

What’s Next For BTC?

The upcoming Jackson Hole Economic Symposium tomorrow, Friday, the place the Federal Reserve will talk about its future methods, is a pivotal occasion on the horizon. Keith Alan of Material Indicators recalled the impression of final 12 months’s symposium on Bitcoin, emphasizing, “Remember when FED Chair Powell spoke from Jackson Hole last year and his hawkish tone triggered a 29% BTC dump?”

While there are parallels in Bitcoin’s value motion main as much as this 12 months’s occasion, it’s essential to notice that market reactions will be unpredictable and hinge on varied components. With the Bitcoin market poised for the occasions of tomorrow, the prevailing temper is one among anticipation combined with warning.

At press time, BTC traded $26,464.

Featured picture from iStock, chart from TradingView.com