The Director of Global Macro at Fidelity Investments, Jurrien Timmer, just lately supplied insights into the potential of the flagship cryptocurrency, Bitcoin, and went so far as labeling the crypto token as “exponential gold.”

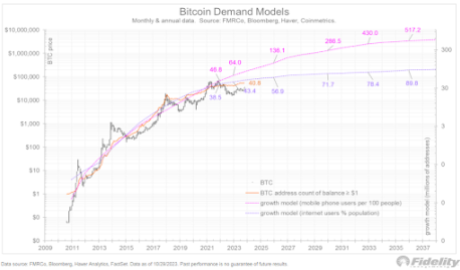

A Glance At Bitcoin’s Adoption Curve

In a submit launched on his X (previously Twitter) platform, Timmer talked about that Bitcoin’s shortage and adoption curve probably enable it to be a “high-powered hedge against monetary shenanigans,” possible alluding to the truth that the token’s options make it an important choice to hedge in opposition to inflation. That is why he sees the token as “exponential gold.”

Source: X

He additional elaborated on Bitcoin’s adoption curve, stating that it has up to now adopted a “typical S-curve shape,” which locations it in good firm with different main improvements that went by such an adoption journey. One of them is cell phones, as Timmer famous that Bitcoin’s adoption curve in 2020 resembled that of cell phones within the ‘80s and ‘90s.

Source: X

Bitcoin, nonetheless, appears to have moved to a different stage within the adoption curve, as Timmer said that the “real-rate narrative changed from dovish in 2020 to hawkish in 2022.” He additional prompt that Bitcoin has moved previous the stage of a fast rise as its adoption curve has flattened out. With this, Timmer believes that it now shares similarities with the adoption curve of the web within the 2000s because the crypto token “has not made much progress since 2021.”

Bitcoin Volatility: Good Or Bad?

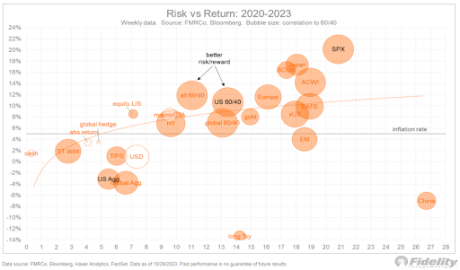

In a subsequent submit, Timmer put Bitcoin’s volatility in perspective as he in contrast it with different asset courses. First, he shared a risk-reward chart for the pandemic and post-pandemic period starting from 2020 to this yr. The SPX appeared to supply the most effective risk-reward with near 24% return.

Source: X

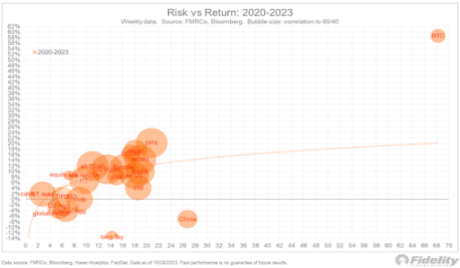

Timmer then went on to share one other chart, which included Bitcoin this time round. The foremost cryptocurrency notably stood out from the remaining, as he talked about that Bitcoin was “in a different universe,” with a 58% return.

Source: X

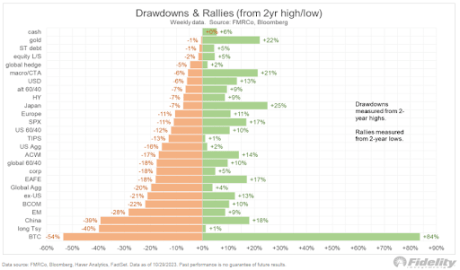

Bitcoin’s excessive volatility appears to have contributed to such returns in no small means, as Timmer talked about that the crypto token’s big drawdowns additionally include massive beneficial properties. To drive house his level, he shared one other chart that confirmed drawdowns and rallies, which numerous asset courses have skilled from their 2-year excessive and low, respectively.

Source: X

The chart confirmed that Bitcoin skilled a 54% drawdown from its two-year excessive however can be up by 84% from its low in the identical interval.

This is extra spectacular when one considers how different asset courses have fared in the identical interval as Timmer said that Government bonds “can’t hold a candle” to Bitcoin’s risk-reward math.

BTC jumps again to $34,800 | Source: BTCUSD on Tradingview.com

Featured picture from Capital.com, chart from Tradingview.com